The taxpayer's Aadhaar number is now mandatory for filing of income tax returns. The e-verification of ITRs can also be done through the Aadhaar number. If e-verified, the ITR-V (acknowledgment) does not have to be sent to the Central Processing Centre (CPC) in Bengaluru. Already 2.6 lakh ITRs have been e-verified in this fiscal using the Aadhaar.

Career Search

Friday, June 30, 2017

New ITR forms ready for e-filing

Edelweiss Tokio POS Saral Nivesh

HDFC Life Click 2 Protect 3D Plus

Thursday, June 29, 2017

Bajaj Allianz Bharat Bhraman

What is Form 16

Income tax Form 16 is a certificate issued by the employer to every employee for each financial year, and it is essential to file income tax returns every year. It lists out various things like the total salary paid to you during the period, the total tax that the employer deducted at source (TDS) and the deductions that you have claimed during the year.

It is issued under section 203 of the Income Tax Act, 1961. It has two parts-A and B.

Part A of the form contains the employee's personal details such as your name and address, employer's name and address, Permanent Account Number (PAN) of both the parties, employer's Tax Deduction Account Number (TAN), and assessment year, i.e., the year in which your tax liability is calculated for the income that you earned in the previous year. It also contains details of the period of employment with your current employer.

Apart from this, it has the summary of the periodic TDS on your income. This will include details on the amount of TDS deducted by your employer during the year, when it was cut, on what income and when it was deposited with the income tax department.

Part B has details of income earned during your employment with the employer. These are basic details such as gross salary, other income, house rent allowance and other allowances provided to you, if any.

It also has details of deductions under sections 80C, 80CCC and 80CCD (such as contributions towards Public Provident Fund, tax-saving mutual fund schemes, life insurance policies and pension). Apart from these, there are deductions under other sections as well. For example, under sections 80D (health insurance premium), 80E (interest on education loan), 80G (donations), and others.

Total deductions are aggregated under "Chapter IV-A" and reduced from gross income to arrive at the taxable income. Your tax liability is calculated on this amount. In the end, part B gives details of tax payable by the employee or refundable to her.

Penalty for delay in issuing Form 16

According to section 203 of the Act, if tax was deducted on the employee's income, the employer has to compulsorily furnish Form 16. However, if there was no TDS on the income, then the employer can decline to issue the form of that employee.

The Act further stipulates that if the Form 16 is not issued by the stipulated deadline (15 June), under section 272A(2)(g) of the Income Tax Act, the employer is liable to pay a penalty of Rs100 per day of default till it issues the form.

Top 10 Tax Saver Mutual Funds for 2017 - 2018

Invest Best Tax Saver Mutual Funds Online

Wednesday, June 28, 2017

HDFC Mid-Cap Opportunities Fund

The twists and turns in mid-cap stocks haven't managed to faze this fund, which has been lodged at a four-star rating without a pause for the last seven years. The fund has earned a four- or five-star rating for the entire period since 2010. Usually parking about 75 per cent in mid-cap companies, the fund has the flexibility to invest up to 25 per cent in large caps. The fund uses this flexibility in a very selective manner. The style is growth at a reasonable price. The fund filters companies that are growing at about 15-20 per cent, with good cash-flow generation and acceptable return on equity.

HDFC Mid-Cap Opportunities Fund three-year CAGR, at 30.3 per cent, and five-year CAGR, at 25 per cent, are about 4-8 percentage points ahead of the benchmark CAGR and 3-4 percentage points more than the returns from the peers. What stands out in its yearly returns is its ability to weather any kind of bear market. In 2008, 2011 and 2013, this was a rare mid-cap fund to contain losses to levels far lower than those of its benchmark. The fund has trailed its benchmark on two occasions since inception and both were big bull years. This may be indicative of its cautious positioning on valuations, despite its growth style.

HDFC Mid-Cap Opportunities Fund showed a slight slippage relative to the benchmark in 2015 but has pulled up its socks thereafter. The AUM has crossed Rs 14,000 crore in recent times. However, its size has so far not proved much of an impediment to performance.

Top 10 Tax Saver Mutual Funds for 2017 - 2018

Best 10 ELSS Mutual Funds to Invest in India for 2017

1. DSP BlackRock Tax Saver Fund

2. Tata India Tax Savings Fund

3. Birla Sun Life Tax Relief 96

4. ICICI Prudential Long Term Equity Fund

5. Invesco India Tax Plan

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Sundaram Diversified Equity Fund

Invest in Best Performing 2017 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Tuesday, June 27, 2017

Birla Sun Life Balanced Advantage Fund

| |||||||||

|

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Friday, June 23, 2017

TDS for Interest of Saving Bank Account Interest

Income tax on savings account interest

Section 80TTA in the Income-tax Act, 1961 has been implemented from the assessment year 2013-14. Under this section, interest up to R10,000 earned from all savings bank accounts is exempt from tax. The account can be with either a bank, a co-operative society engaged in carrying out the business of banking (including a co-operative land mortgage bank or a co-operative land development bank), or a post office.

In case interest earned is more than R10,000 in a financial year, the difference will attract tax. So, if your interest income from the savings accounts is R9,000, you don't have to pay any tax on it. But if it is R18,000, you need to pay income tax on R8,000 according to your tax slab. Remember, deduction under section 80TTA is not available on interest earned on fixed deposits or term deposits with a bank or post office.

Tax Liability

It is the responsibility of the account holder to evaluate her interest income and pay the tax accordingly. Interest income from a savings bank account is considered under the head "income from other sources". You can either disclose or declare the interest earned from different savings accounts to your employer and ask it to deduct the TDS on your income, or you can pay the taxes on your own. If the amount is substantial, you may also need to pay advance tax on it. You should evaluate your tax liability on interest earned before the advance tax due dates and make the payment accordingly. You do not have to attach an interest certificate while filing income tax returns. However, you should retain the original certificate to show it to the assessing officer in case of a tax scrutiny.

Our Sugesstion

Usually, tax filers do not evaluate or disclose their interest earnings from savings accounts and the taxes due on it while filing income tax returns. But it would be sensible to do so; one should take advantage of the available deduction limit specified specially for such income and file the return accordingly. Not only is it incorrect to avoid or ignore savings account interest while filing tax return, but may also be penalised. You may have to file a revised return.

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Thursday, June 22, 2017

How to fix Mistake in your Tax Return?

Verifying your returns A revised return must also be verified. You can verify it via net banking or adhaar OTP. You can also send the physical ITR-V to CPC, Bangalore, however remember to send the ITR-V of the revised return. ITR-V is sent as an attachment by the income tax department to your registered email id.

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

What is NPS

NPS

National Pension System (NPS) is a voluntary, defined contribution retirement savings scheme designed to enable the subscribers to make optimum decisions regarding their future through systematic savings during their working life. NPS seeks to inculcate the habit of saving for retirement amongst the citizens.

As per the latest announcement, the total available limit available for tax deduction through NPS is Rs. 2 lakh, which includes Rs. 1.5 lakh under Sec 80C. This makes the product one of the best among all other tax saving options. We help investors make selective choice under the available funds in NPS.

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Wednesday, June 21, 2017

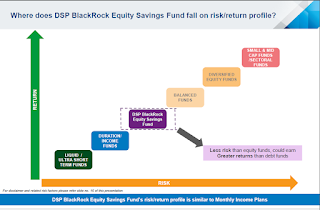

DSP BlackRock Equity Savings Fund

Top 10 Tax Saver Mutual Funds for 2017 - 2018

Best 10 ELSS Mutual Funds to Invest in India for 2017

1. DSP BlackRock Tax Saver Fund

2. Tata India Tax Savings Fund

3. Birla Sun Life Tax Relief 96

4. ICICI Prudential Long Term Equity Fund

5. Invesco India Tax Plan

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Sundaram Diversified Equity Fund

Invest in Best Performing 2017 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

How to Enable E-filing Vault on Income Tax Website

1. E-Filing Vault – Higher Security

Restricting the methods/options for Login and locking the reset password options will secure account from possible mis-use. This is for additional security or secured access.

Pre-requisites

- User should be registered in the e-Filing portal.

- A valid DSC is already registered in the e-Filing application.

- A valid Aadhaar should be linked with PAN in e-Filing (In Case of Individual Users)

2. Steps involved in E-Filing Vault-Higher Security Process

Step 1 – Login to e-Filing portal using user Credentials.

Step 2 – Navigate to Profile Settings ⇒ E-Filing Vault-Higher Security. The following screen is displayed.

Step 3 – User can select the required options to secure the account. On Success, user will be allowed to login and Reset Password only with the above selected option(s).

| Fields | Pre-requisite to avail the options | |

| Login through Net Banking | • | Users should have logged-in to e‑Filing portal through Net-banking atleast once to avail this option |

| Login Using DSC | • | Users need to register Digital Signature Certificate before opting for 'Login Using DSC'. To register DSC, Go to My Profile ⇒ Register Digital |

| Login Using Aadhaar OTP | • | Users need to Link Aadhaar to the PAN before opting for 'Login Using Aadhaar OTP'. To Link Aadhaar, Go to My Profile ⇒ Link Aadhaar. |

3. Login with Higher Security Options

Login through net-banking

If the user chooses Login through net-banking, along with e-Filing User ID and Password, user will be required to login through Net Banking. This ensures additional security to user's e-Filing account.

- User needs to select the option "Login through net-banking". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user logs in, the user is redirected to "e-Filing Login Through NetBanking" page where the user needs to select his / her bank and login to the

- User must select his/her bank from the list of the banks provided.

- After login to NetBanking account, click on the link "Login to the IT e-Filing account".

- User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login through NetBanking" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Login Using DSC

If the user chooses Login using DSC, along with e-Filing User ID and Password, user will be required to login using DSC. This ensures additional security to user's e-Filing account.

- User needs to select the option "Login using DSC". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user logs in, the user is redirected to Secured Login Option page where the user needs to select the either New or Registered DSC, and upload the signature file generated using DSC Management utility. Click Submit.

- User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login using DSC" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Login Using Aadhaar OTP

If the user chooses Login using Aadhaar OTP, along with e-Filing User ID and Password, user will be required to login using Aadhaar OTP generated. If user has linked Aadhaar to the PAN a request is made to the Aadhaar Web service, OTP is generated and sent to the Mobile Number registered with UIDAI. This ensures additional security to user's e-Filing account.

- User needs to select the option "Login using Aadhaar OTP". Once the user selects the checkbox, below confirmation appears. Click "Generate Aadhaar OTP" button.

- Aadhaar OTP is successfully generated and will be sent to the Mobile Number registered with Aadhaar.

- Enter the Aadhaar OTP and click Validate.

- Success message is displayed on the screen. Click on "OK" and click "Proceed"

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user logs in, the user is redirected to Aadhaar OTP Login page where the user needs to generate Aadhaar OTP. Click Generate Aadhaar OTP button.

- Aadhaar OTP is successfully generated and will be sent to the Mobile Number registered with Aadhaar.

- Aadhaar OTP will be validated and the User will be redirected to e-Filing dashboard.

User can deactivate the Secured Login at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Login using Aadhaar OTP" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

4. Lock Reset Password Options

If the user forgets his/her password, then the user will be required to use the option selected using this process to reset password. The existing options of e-Filing OTP and Secret Question will be disabled. This will provide additional security to e-Filing account.

Reset Password through net-banking

This is a default option available. At any time the user can reset his/her password using NetBanking option.

- In the Login Page, click "Forgot Password?" link.

- User will be redirected to a Reset Password page. Enter the User ID and Captcha Code and click Continue.

- Click on "e-Filing Login Through NetBanking" link.

- User must select the bank from the list of the banks provided.

- After login to NetBanking account, click on the link "Login to the IT e-Filing account".

- User will be redirected to e-Filing dashboard.

- User can change the password under Profile Settings ⇒ Reset Password.

Reset Password Using DSC

If the user chooses to reset the password using DSC, all the other options to reset the password will be disabled and the user can reset the password only using DSC. This ensures additional security to user's e-Filing account.

- User needs to select the option "Using DSC". Once the user selects the checkbox, below confirmation appears. Click "OK" and click the "Proceed" button.

- User will be redirected to a confirmation page.

- Click on "Confirm" button. Success message is displayed on the screen.

- Next time the user wishes to reset password, click on "Forgot Password link?" in the Login Page.

- User will be redirected to a Reset Password page. Enter the User ID and Captcha Code and click Continue.

- User can reset his password only using DSC.

- Select the option "Using DSC" and click Continue. User is redirected to a page where he can select the type of DSC and upload the signature file generated using DSC Management Utility.

- Click on "Validate" button. User is redirected to a page where he can Change the

- Enter the New Password and re-enter the Password and click "Submit" button. Success message is displayed on the screen.

User can deactivate the Secured Reset Password at any time.

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Using DSC" and click Proceed button.

- User will be redirected to a confirmation page.

- Click on Disable button. Success message is displayed on the screen.

Reset Password Using Aadhaar OTP

Success message is displayed on the screen. Click on "OK" and click "Proceed"

Go to Profile Settings ⇒ E-Filing Vault – Higher Security and unselect the option "Using Aadhaar OTP" and click Proceed button.

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300