Invest In Tax Saving Mutual Funds Online

Action Plan

- A major part of your portfolio should provide fixed and regular income

- Senior Citizens Savings Schemes is one of the best options available

- To add a mix of equity, you can opt for equity-linked saving schemes

Once you retire, your cash inflow dries up as you lose your primary source of income. So, you have to invariably rely on your pension and return from investments. In this backdrop, tax planning assumes great significance for the retired.

Estimate your total income. If you are above 60, any income up to Rs 2.4 lakh is tax-exempt. For those above 80, a new tax slab has been introduced from this year—very senior citizen—under which income up to Rs 5 lakh is exempted from tax. If your total income is within the exempted limit and you are still paying tax deducted at source (TDS) on your investment (fresh and existing), furnish the respective declaration forms to the concerned sources for non-deduction of tax. Returns on investments, such as fixed deposits and bonds, among others, attract TDS. Suppose, your total income (interest) from FDs exceeds Rs 10,000 (at branch level) in a year, a TDS of 10.3 per cent would be applicable. To avoid paying this TDS, you need to submit Form 15G (if your age is less than 60) at the beginning of every financial year. If you are older than 60, you need to submit Form 15H.

Where to invest? If you have just retired, don't rush to invest the retirement corpus (provident fund, gratuity or other accumulated benefits). You can invest the amount any time during the financial year in tax-saving instruments. Figure out the deficit between your expected income and expenses. Choose instruments which not only give you regular income to overcome this deficit, but are also tax-efficient. Till the time you plan your portfolio, park your money in liquid funds. Stagger non-tax-saving investments across maturities. If you have already retired and your total expected income is more than the tax-exempt limit, invest in tax-savings instruments (see Tax Savers for the Golden Years). Apart from reducing the tax outgo, you should also look at safety, interest rate, frequency of return and the duration of investment.

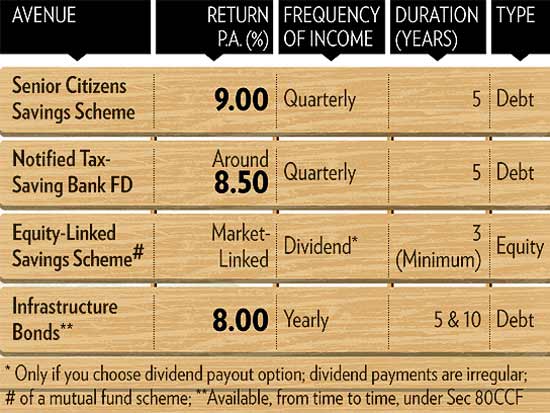

Tax Savers For The Golden Years

A comparative study of the choices available

A major part of your portfolio should comprise instruments which provide fixed and regular source of income. The Senior Citizens Savings Scheme (SCSS) is easily the best option here. It not only provides tax exemption under Section 80C, but also gives a high rate of return (9 per cent per annum). While the Monthly Income Scheme (MIS) provides regular monthly income, it doesn't come with tax exemption. On the other hand, a five-year Post Office Term Deposit provides tax exemption, but gives much lower returns (7.5 per cent p.a.). Corporate fixed deposit is another option which promises high returns, but carries higher risk. An ideal portfolio has a mix of equity instruments in it as well. Equity-linked savings schemes (ELSS) are a good option as they provide both exposure in equity and income in form of dividend, if you choose the dividend payout option. Also, an ELSS has a lock-in period of just three years and can be continued further. Dividend and returns from it are tax-free.

Insurance. In most cases, a retired person may not need a life insurance cover as most of his financial liabilities would have been met. But, if you still intend to take one if you have dependents, go for a term cover. Avoid a long-term commitment through a unit-linked insurance plan (Ulip) or an endowment plan.

Additional deduction. After investing in the abovementioned 80C instruments, which have an overall tax exemption limit of Rs 1 lakh, if you are still left with taxable income, you may consider long-term infrastructure bonds (LTIB), which provide deduction of up to Rs 20,000 under Sec 80CCF. LTIB have a lock-in of five and 10 years and return about 8 per cent p.a., which can be withdrawn every year. But the interest earned is taxable.

Happy Investing!!

We can help. Call 0 94 8300 8300 (India)

Leave your comment with mail ID and we will answer them

OR

You can write back to us at PrajnaCapital [at] Gmail [dot] Com

---------------------------------------------

Invest in Tax Saving Mutual Funds ( ELSS Mutual Funds ) to upto Rs 1 lakh and Save tax under Section 80C.

Invest Tax Saving Mutual Funds Online

Tax Saving Mutual Funds Online

These links can be used to Purchase Mutual Funds Online that are regular also (Investment, non-tax saving)

Download Tax Saving Mutual Fund Application Forms from all AMCs

Download Tax Saving Mutual Fund Applications

These Application Forms can be used for buying regular mutual funds also

Some of the best Tax Saving Mutual Funds available ( ELSS Mutual Funds )

- ICICI Prudential Tax Plan Invest Online

- HDFC TaxSaver Invest Online

- DSP BlackRock Tax Saver Fund Invest Online

- Reliance Tax Saver (ELSS) Fund Invest Online

- Birla Sun Life Tax Relief '96 Invest Online

- IDFC Tax Advantage (ELSS) Fund Invest Online

- SBI Magnum Tax Gain Scheme 1993 Invest Online

- Sundaram Tax Saver Invest Online

- Edelweiss ELSS Invest Online

Best Performing Mutual Funds

- Largecap Funds Invest Online

- DSP BlackRock Top 100 Fund

- ICICI Prudential Focused Blue Chip Fund

- Birla Sun Life Front Line Equity Fund

- Large and Midcap Funds Invest Online

- ICICI Prudential Dynamic Plan

- HDFC Top 200 Fund

- UTI Dividend Yield Fund

- Mid and SmallCap Funds Invest Online

- Reliance Equity Opportunities Fund

- DSP BlackRock Small & Midcap Fund

- Sundaram Select Midcap

- IDFC Premier Equity Fund

- Small and MicroCap Funds Invest Online

- DSP BlackRock MicroCap Fund

- Sector Funds Invest Online

- Reliance Banking Fund

- Reliance Banking Fund

- Tax Saver MutualFunds Invest Online

- ICICI Prudential Tax Plan

- HDFC Taxsaver

- DSP BlackRock Tax Saver Fund

- Reliance Tax Saver (ELSS) Fund

- Gold Mutual Funds Invest Online

- Relaince Gold Savings Fund

- ICICI Prudential Regular Gold Savings Fund

- HDFC Gold Fund

No comments:

Post a Comment