Invest In Tax Saving Mutual Funds Online

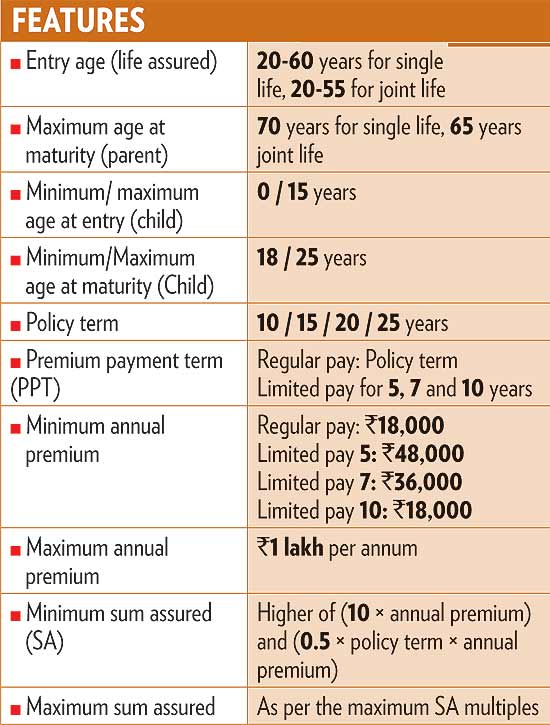

SmartKid Premier from ICICI Prudential Life is a unit-linked insurance plan (Ulip) for children with three portfolio strategies.

Portfolio strategy. The first option is fixed portfolio strategy which allocates money in the funds of your choice. Second is life-cycle based portfolio strategy which allocates between debt and equity depending on your age. Third is portfolio strategy which is based on pre-defined asset allocation.

Partial withdrawals. Partial withdrawals are allowed from the sixth policy year up to a maximum of 20 per cent of the fund value. Only one partial withdrawal is allowed in a year.

Death benefit. In case of the death of the life assured before the maturity of the policy, it pays the sum assured. It also offers an in-built option of waiver of premium where all future premiums are waived by the company.

Loyalty addition. Starting from the end of the 10th policy year, after every five years, 2 per cent of the average fund value (on the last day of the 8-policy quarters) is paid into the fund.

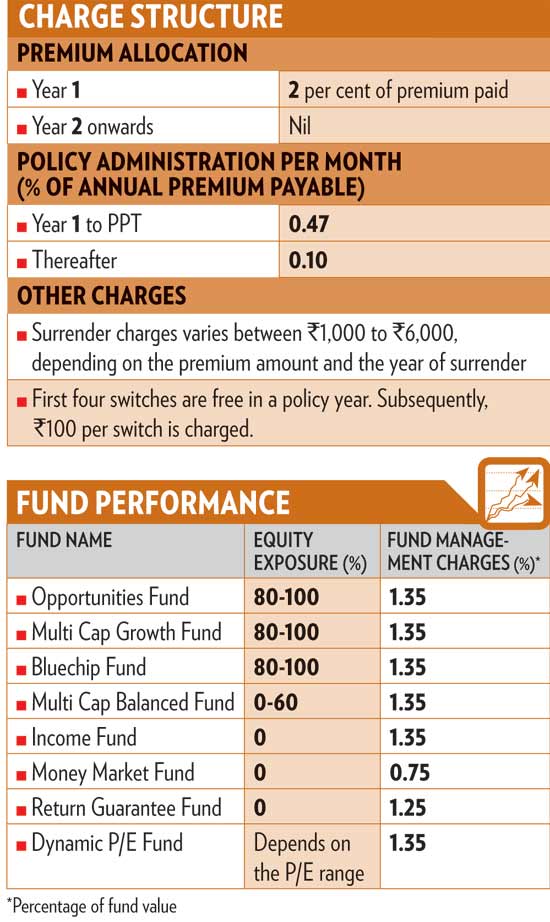

Cost. For a 35-year-old male paying annual premiums of Rs 50,000 for 15 years for a sum assured of Rs 10 lakh, the policy will pay Rs 9.23 lakh and Rs 13.06 lakh at an assumed annual growth rate of 6 per cent and 10 per cent, respectively. The net yield comes to 6.85 per cent at an annual assumed growth rate of 10 per cent.

Comparison. For similar plans, such as Bharti AXA Life Bright Star Edge and Max New York Life Shiksha Plus II, the net yield comes to 6.80 per cent and 6.44 per cent, respectively, at an assumed annual growth rate of 10 per cent.

Conclusion. For goal-oriented parents who want to save for their kids, this is a good plan to invest in.

Happy Investing!!

We can help. Call 0 94 8300 8300 (India)

Leave your comment with mail ID and we will answer them

OR

You can write back to us at PrajnaCapital [at] Gmail [dot] Com

---------------------------------------------

Invest in Tax Saving Mutual Funds ( ELSS Mutual Funds ) to upto Rs 1 lakh and Save tax under Section 80C.

Invest Tax Saving Mutual Funds Online

Tax Saving Mutual Funds Online

These links can be used to Purchase Mutual Funds Online that are regular also (Investment, non-tax saving)

Download Tax Saving Mutual Fund Application Forms from all AMCs

Download Tax Saving Mutual Fund Applications

These Application Forms can be used for buying regular mutual funds also

Some of the best Tax Saving Mutual Funds available ( ELSS Mutual Funds )

- ICICI Prudential Tax Plan Invest Online

- HDFC TaxSaver Invest Online

- DSP BlackRock Tax Saver Fund Invest Online

- Reliance Tax Saver (ELSS) Fund Invest Online

- Birla Sun Life Tax Relief '96 Invest Online

- IDFC Tax Advantage (ELSS) Fund Invest Online

- SBI Magnum Tax Gain Scheme 1993 Invest Online

- Sundaram Tax Saver Invest Online

- Edelweiss ELSS Invest Online

Best Performing Mutual Funds

- Largecap Funds Invest Online

- DSP BlackRock Top 100 Fund

- ICICI Prudential Focused Blue Chip Fund

- Birla Sun Life Front Line Equity Fund

- Large and Midcap Funds Invest Online

- ICICI Prudential Dynamic Plan

- HDFC Top 200 Fund

- UTI Dividend Yield Fund

- Mid and SmallCap Funds Invest Online

- Reliance Equity Opportunities Fund

- DSP BlackRock Small & Midcap Fund

- Sundaram Select Midcap

- IDFC Premier Equity Fund

- Small and MicroCap Funds Invest Online

- DSP BlackRock MicroCap Fund

- Sector Funds Invest Online

- Reliance Banking Fund

- Reliance Banking Fund

- Tax Saver MutualFunds Invest Online

- ICICI Prudential Tax Plan

- HDFC Taxsaver

- DSP BlackRock Tax Saver Fund

- Reliance Tax Saver (ELSS) Fund

- Gold Mutual Funds Invest Online

- Relaince Gold Savings Fund

- ICICI Prudential Regular Gold Savings Fund

- HDFC Gold Fund

No comments:

Post a Comment