You can earn higher returns by parking your surplus cash in like liquid funds, instead of leaving it in your savings bank accounts. While savings bank pays an interest of 4%, liquid funds can give you pre-tax annual returns of 9 – 10%. In this article, we will discuss about another short term option for parking your surplus funds, namely ultra short term debt fund. Like liquid funds, ultra short term debt funds are also money market mutual funds. They invest primarily in money market instruments like treasury bills, certificate of deposits and commercial papers, with the objective of providing investors an opportunity to earn returns, without compromising on the liquidity of the investment. While liquid funds invest in money market securities that have a residual maturity of less than or equal to 91 days, ultra short term debt funds invest in securities that mature in 6 to 12 months. Longer average maturities, enable ultra short debt funds get higher returns than liquid funds. However for the same reason, the volatilities of the short term debt funds are also slightly higher than liquid funds

Key Differences with Liquid Funds:

Exit Load:

Most liquid funds do not have any exit load. Some ultra short debt funds have no exit loads, but some funds charge a small exit load (around 25 bps) for redemption within a month.Higher returns:

Ultra short debt funds can give higher returns than liquid funds. Highly rated liquid funds have given around 9.5% pre-tax returns, whereas highly rated ultra short term debt funds have given 9.5 – 10.5% pre-tax returns.Higher volatility:

Ultra short debt funds are slightly more volatile than liquid funds, since the underlying securities in their investment portfolio have longer durations or maturities than liquid funds. Fixed income securities with shorter durations or maturities have lower interest rate risk, since the probability of the interest rate changing before the maturity of the securities is lower.Allotment of Units:

For liquid funds if the application is submitted before 2pm the units are allotted at previous day's NAV. For applications submitted after 2pm the units are allotted at the same day's NAV. For ultra short debt funds if the application is submitted by 3pm the units are allotted at the same day's NAV. For applications submitted after 3pm the units are allotted at the next day's NAV.

Choosing between liquid funds and ultra short debt funds

It depends on your "investment horizon". By investment horizon here, we mean the period before which you are not likely to redeem. If your investment horizon is less than three months, then you should invest in liquid funds. However, if your investment horizon is more than three months to one year, you should invest in ultra short debt funds to get higher returns. If your investment horizon is more than a year, you should choose FMPs or open ended schemes depending on your objectives.

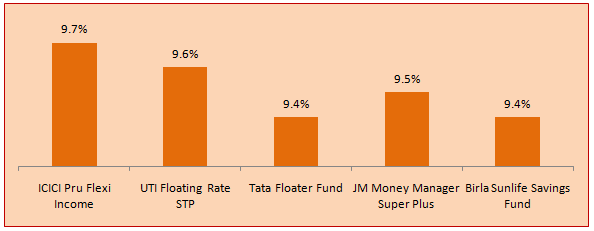

Performance of top ranked ultra short term debt funds

The chart below shows the last 1 year returns of some of the top rated (based on CRISIL rankings) ultra short debt funds. One should note that, the CRISIL ratings for ultra short term debt funds, is not just based on returns, but on a variety of important parameters like average returns, volatility, asset size, modified duration, dividend reinvestment, asset quality, company concentration risk and portfolio liquidity. The returns in the chart below are for the regular plans of the funds. The direct plans of the funds have slightly higher returns.

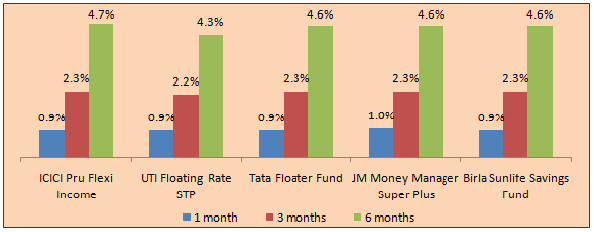

Clearly ultra short term debt funds have given much higher returns than savings bank accounts over the last one year. In fact, they have given slightly better returns than liquid funds as well, over the last one year. Not just in terms of one year returns, ultra short term debt funds have given higher returns even in the one month, three months and six months time frames, compared to liquid funds. See the chart below.

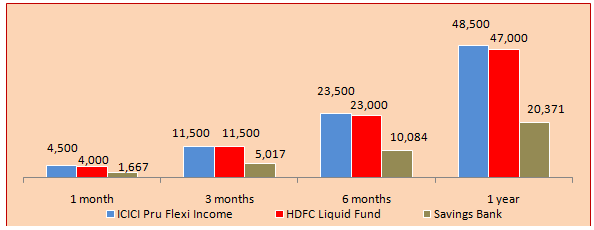

The chart below shows the pre tax returns of Rs 5 lakhs investment in an ultra short debt fund (e.g. ICICI Prudential Flexi Income Fund), liquid fund (e.g. HDFC Liquid Fund) and savings bank (with average daily balance of Rs 5 lakhs) over one month, three months, six months and one year investment time horizon.

The chart above shows that if you have a timeframe of over three months to a year, then ultra short term debt funds can provide slightly better returns than debt fund. At any point of time, if you need the funds you can put in a redemption request and funds are transferred to your bank account, usually within one business day.

Taxation Issues

Short term capital gains from ultra short term debt funds are taxed at the applicable income tax slab rate of the investor. Dividends from ultra short term debt funds are tax free in the hands of the investors, but the fund houses have to pay a dividend distribution tax (DDT) of 28.325% before distributing dividends to the investors. Investors should consider their individual tax situations and tax treatment of these funds, when they select the distribution option of an ultra short term debt fund. Ultra short term debt funds come with different distribution options e.g. growth plan, daily dividend plan, monthly dividend plan etc. If you fall in the 10% or 20% tax bracket, you should invest in the growth plan, since your tax rate is lower than the dividend distribution tax rate. On the other hand, if you are in the highest tax bracket (30%), then dividend re-investment will be smarter option from a tax perspective. Let us illustrate with an example.

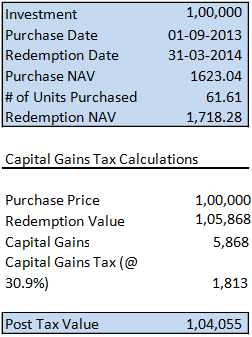

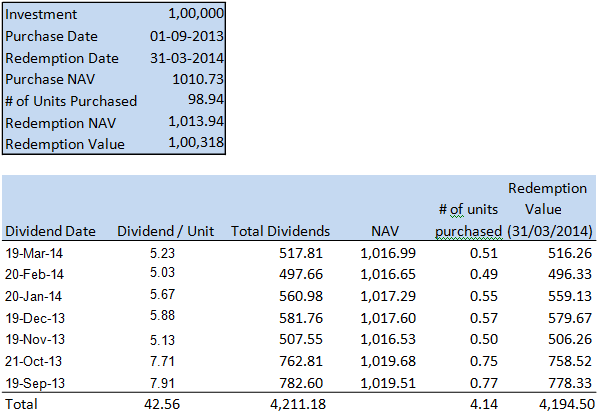

Let us assume you are an investor in the highest tax bracket. You have invested Rs 1 lakh of your surplus cash in Reliance Money Manager Fund (Retail) on Sep 1, 2013. You redeemed your units on Mar 31, 2014. You had two options in which to invest your funds.

- Growth Plan

- Monthly Dividend Plan, with Dividend Reinvestment

Let us examine your returns in each of these options.

Option 1: Growth Plan

The post tax value of your investment on redemption is Rs 1,04,055. Let us examine your returns, if you had chosen the monthly dividend plan, with dividend re-investment.

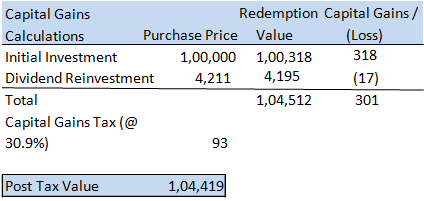

Option 2: Monthly dividend plan with dividend re-investment

The post tax value of your investment on redemption is Rs 1,04,419. Clearly, you are better off with dividend re-investment option. This is because, in the growth option you had pay capital gains tax at the rate of 30.9%, whereas in the dividend re-investment option the dividends were stripped from the NAV by the fund house after paying divided distribution tax at 28.35% and you had to pay very little capital gains tax.

Conclusion

Money market mutual funds, like liquid funds and ultra short term debt funds are much smarter options of earning higher returns on your surplus funds than having it lie idle in your savings bank account. The underlying assets of top money market mutual funds, both liquid funds and ultra short term debt funds, have high credit quality. Therefore the risk in these investments is very low. As such, SEBI colour codes these funds blue, which signifies low risk. As discussed above, you should choose between liquid funds and ultra short term debt funds, depending on your investment horizon. You should consult with your financial adviser if ultra short term debt funds are suitable for parking your surplus funds for a short term.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment