In India Income Tax Savers have a whole range of tax saving instruments available to them under Section 80C of Income Tax Act. Few common options are as follows –

Public Provident Fund (PPF): It is one the oldest and most popular choices as it offers assured interest rate while ensuring capital safety and liquidity. The interest rate may vary from year to year. It has been fixed at 8.7% for this financial year (2014 – 15). The tenure of this instrument is 15 years, and is extendable in blocks of 5 years. Withdrawals not exceeding 50% of 4th year balance are permitted after a lock-in period of 7 years. Currently the maximum and minimum investment amounts under PPF is Rs. 150,000 and Rs 500 respectively

5 year Tax Saving Bank Fixed Deposit: 5 year Tax Saving Bank Fixed Deposits are very much secured and currently offers an assured Interest rate in the range of 8.50% to 9.1%. Maximum investment allowed is Rs. 150,000 in one year. It is important to note that interest earned by these FDs is fully taxable, at the applicable IT rates applicable to you.

National Savings Certificates (NSC): It is a popular investment choice for many years now. While the new NSC scheme offers interest rates at 8.5% and 8.8%, for the 5 and 10 year maturities respectively the interest earned in NSC is fully taxable as per income IT rates applicable to you

Employee contribution to Provident Fund (EPF): Your employer deducts your contribution from your monthly salary (12% of your basic) and deposit in your Provident Fund account. The equivalent amount known as Employer's contribution is also made to this account. The annual interest earned on your PF is around 8.5%. Provident Fund offers limited liquidity as you cannot redeem the full funds till your retirement excepting partial withdrawals or loans allowed under certain special circumstances. Maximum deduction allowed for tax rebate for FY 2014-15 is Rs. 150,000

Life Insurance policies – This is the most popular option in India as traditionally most of the Insurance policies are bought or sold on the pretext or purpose of tax saving. In the traditional plans, the maturity amount equivalent to the sum assured is guaranteed and the premium is fixed for the tenure of the policy. The life risk upto the sum assured in the policy is guaranteed as per the terms of the policy as long as the premiums are paid in time and the policy is in force. In addition to the above a maturity bonus is also paid to the policy holder upon maturity. The returns from these policies are not attractive as a significant portion of the premium is paid to cover the mortality charges. However, ULIP plans offer market linked return but not very popular due to the volatility attached to it.

Equity Linked Savings Schemes (ELSS) from mutual Funds – ELSS are nothing but diversified equity funds which not only offers Tax benefit upto Rs.150,000 but also offers tax free dividends and tax free long term capital gains. ELSS are locked – in for 3 years only. Today, we will discuss more about ELSS as this is currently the best Tax Saving option for Investors.

Why you should invest in an ELSS fund -

- An opportunity to grow your money by investing in the equity market through professional fund managers.

- Long-term capital gains from these funds are tax free in your hands.

- The low lock-in period of only 3 years compared to other options.

- You can also opt for a Dividend Payout option, thereby you may realize some profits even if the fund is locked-in for three years. Dividend from ELSS Mutual Funds are also tax free

- Apart from lumpsum, you can invest also through Systematic Investment Plan (SIP) route and thus benefit from rupee cost averaging. This means that if you start a SIP in an ELSS Fund, then each of your investments will be locked in for 3 years from the respective investment dates.

- Some ELSS Funds also offer Free Life insurance

- For the current FY, you can claim deduction upto Rs. 150,000 on your ELSS investment as a deduction from your gross total income in a financial year under Sec 80C of the Income Tax Act.

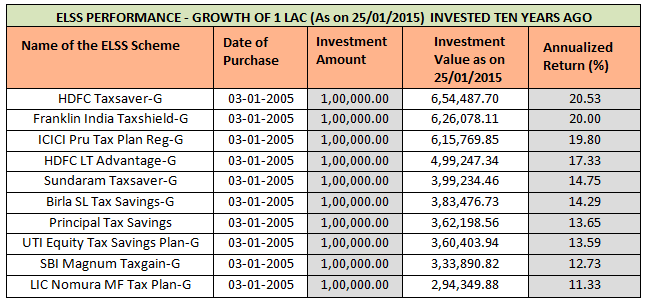

What is the track record of ELSS Funds – When we invest in bank FDs, NSC and PPF etc. we know the fixed rate of returns that these instruments offer! But, in case of ELSS there are no assured returns as it is market linked. However, if you see the track record of ELSS fund for last 10 – 15 years they have given the best returns.

As you can see, during the last 10 years the best performers generated around 20% annualized returns while the worst performer gave 11.33%. Even the worst performer has given more returns than NSC, PPF, Insurance policies and FDs.

A lumpsum investment of Rs.100,000 made 10 years ago in a good ELSS fund has now grown more than 6 times!

(Please note that the above is not an exhaustive list of ELSS Funds. We have taken randomly ten ELSS funds from a list of funds which are in existence for more than 10 years)

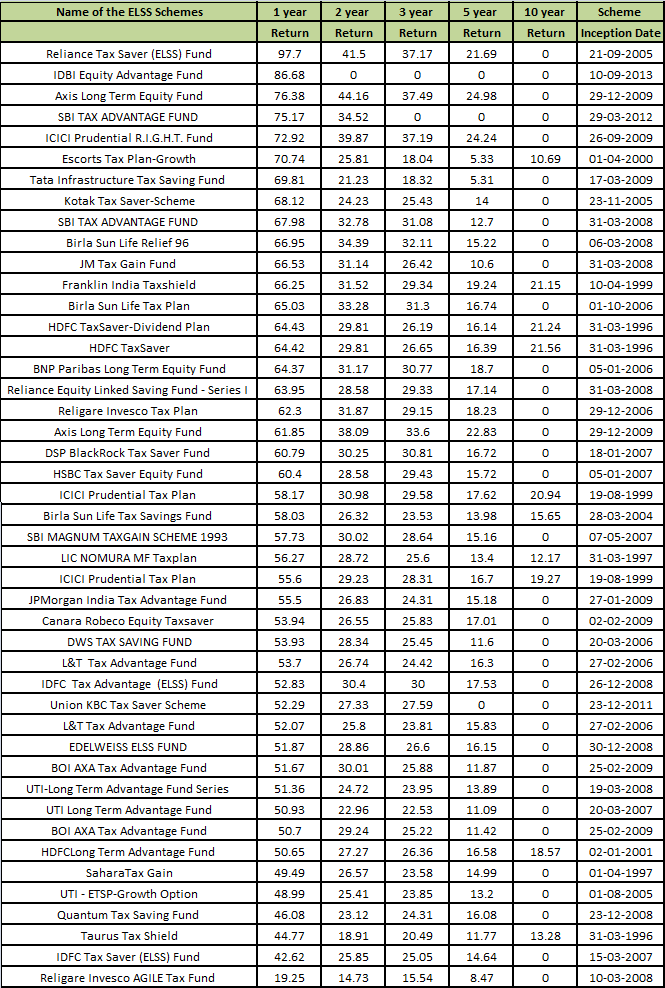

Now, let us see an exhaustive list of ELSS Funds returns over different time periods –

Source: Advisorkhoj Research

Conclusion

As you can clearly see that the ELSS funds have been successful in creating wealth for investors over longer period of time. However, remember to do thorough research and consult a financial advisor when you invest in these ELSS funds as the gap between the best and worst performance is quite huge. One must look at the long term performance of the fund, the Fund house itself, the fund manager's investment approach, portfolio and the expense ratio of the fund etc.

The performances of the ELSS funds are determined by the stock market performance in general. If an investor, whose risk taking appetite is low, gets better tax-adjusted returns from other investment avenues like debt, he will prefer to go for that, as risk is lower. But over a longer period of time, ELSS funds are the best tax saving investment especially if you are willing to take a little amount of risk.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment