National Savings Certificate (NSC) offered by Post Offices has been a popular tax saving investment choice for many years. Its popularity may have diminished somewhat, with the advent of market linked tax saving investment options like equity linked savings scheme and unit linked insurance plans. However, given the risk free nature of the instrument and the distribution reach of postal network across the length and breadth of the country, National Savings Certificate continues to be a popular small savings instrument across the country. In the new NSC scheme, the interest rate of the VIII issue with 5 years maturity is 8.5% and that of the IX issue with 10 years maturity is 8.8%. The interest is compounded on a half yearly basis but is payable on maturity. The minimum NSC investment is Rs 100. NSCs are available in denominations of Rs 100, 500, 1000, and 10,000, with no maximum limit.

Tax Treatment

- The NSC deposits qualify for tax savings under Section 80C of the Income Tax Act, subject to the overall limit of Rs 1 lakh allowed under Section 80C

- The interest accruing annually is deemed to be reinvested for tax savings under Section 80C of the Income Tax Act, again subject to the overall limit of Rs 1 lakh allowed under Section 80C

- The interest earned in NSC is taxable at the applicable income tax slab rate for the investor. Investors should note that if the accrued interest is not taxed every year on an accrual basis then the entire income is taxable on maturity. Even though the interest income in NSC is taxable no TDS certificate is issued.

How to maximize tax savings in NSC

In the annual Income Tax Return (ITR) the accrued interest for the year should be declared as taxable income under the heading "Income from other sources". At the same time, the assesses should show the accrued interest as "NSC accrued interest deemed for re-investment" in section 80C for deductions from taxable income. Both these items cancel out each other and therefore the interest becomes tax free for the assesses or investor. The assesses should then continue to declare the accrued interest both as "Income from other sources" and "NSC accrued interest deemed for re-investment" under Section 80C, throughout the term of his investment except the year of maturity. In the year of maturity, the assesses should declare the accrued interest for that year as "Income from other sources". However, he or she cannot claim an 80C deduction for the accrued interest, because the interest is re-invested but paid to the investor. Investors should note that, NSC interest would only qualify for the deduction as long as it is within the overall Rs 1 lakh limit in Section 80C. Employee provident fund contributions, insurance premiums, housing loan principal repayments, tuition fees, public provident funds, equity linked savings schemes and fresh NSC deposits are also covered under the same Rs 1 lakh limit.

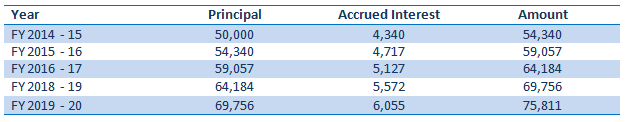

Let us examine the tax treatment in more details with the help of an example. Assume you had invested Rs 50,000 in VIII issue of NSC on April 1 2014. Your NSC has an interest rate is 8.5% and will mature in 5 years. Let us further assume that you fall in the highest (30%) tax bracket. At the end of financial year 2014 – 2015, the accrued interest with half yearly compounding will be Rs 4,340 (please refer to our article, How Compound interest works. This interest will not be payable to you, but will be added to the principal amount and will continue to compound on a half yearly basis till maturity. What should you do, when you fill your Income Tax Returns for FY 2014 - 2015?

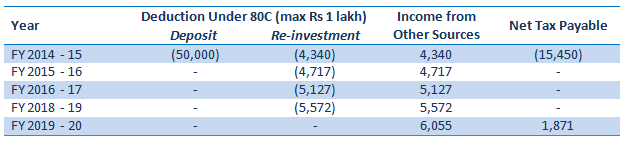

- Under Section 80C, claim deduction for Rs 50,000 NSC deposit

- Under Section 80C, again claim deduction for Rs 4,340 accrued interest deemed for re-investment

- Declare accrued interest Rs 4,340 as "Income from other sources"

Total tax savings for the financial year 2014 – 2015 will be Rs 15,450 (Rs 50,000 X 30.9% tax rate).

In FY 2015 – 2016, the accrued interest will be Rs 4,717. What will you do when you fill your Income Tax Returns for FY 2015 - 2016?

- Under Section 80C, again claim deduction for Rs 4,717 accrued interest deemed for re-investment

- Declare accrued interest Rs 4,717 as "Income from other sources"

Tax payable and tax saving will cancel out each other, and the accrued interest becomes tax free. You should repeat this every year till FY 2019 – 2020.

Please see the table below for the accrued interest schedule of the Rs 50,000 NSC deposit over the term of the investment.

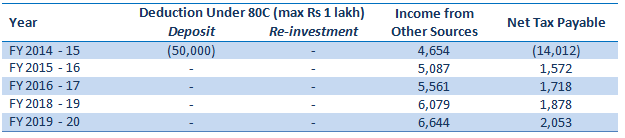

Please see the table below for the income tax calculation for the NSC.

The above table shows, how you can maximize your tax savings by declaring the accrued interest of your NSC in your Income Tax Returns. If you do not declare the accrued interest in your Income every year, the entire income of Rs 25,811 will be taxable on maturity. By declaring accrued interest as income and claiming benefit under Section 80C you save Rs 6,100 in taxes over the term of the investment.

How does NSC compare with Tax Saving Fixed Deposits

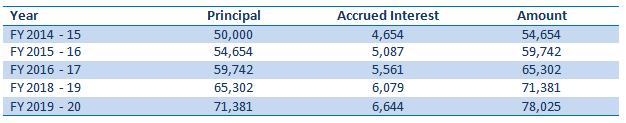

5 year Tax Saving Bank Fixed Deposits also qualify for deduction under Section 80C of the Income Tax Act. Interest rates on the 5 year Fixed Deposits range from 8 to 9.5%. A majority of the banks offer 8.5 – 9% interest rate on 5 year Fixed Deposits. Interest in fixed deposits is compounded on a quarterly basis and therefore on pre-tax basis, the returns are higher than NSC. However, accrued interest in bank fixed deposits does not qualify for 80C deductions. Let us examine how bank fixed deposits compare with National Savings Certificates.

Please see the table below for the accrued interest schedule of the Rs 50,000 5 year tax saving fixed deposit over the term of the investment.

Clearly on a pre tax basis, FDs give better returns. Please see the table below for the income tax calculation for the FD.

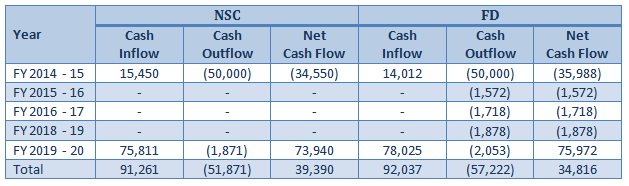

As you can see the tax payable for bank FD is much higher. To compare the NSC and FD, let us compare the cash flows for both of these investments.

You can see in the table above NSC gives better cash flows than FDs. This is because of the tax saving feature of accrued interest in NSCs.

Conclusion

Tax is a consequence which no one can escape from. Different investment products have different tax consequences. As such tax treatment should be an important consideration for any investment choice. Investors should maximize their tax savings from their National Savings Certificate investment in order to maximize their post tax yields.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment