Top SIP Funds Online

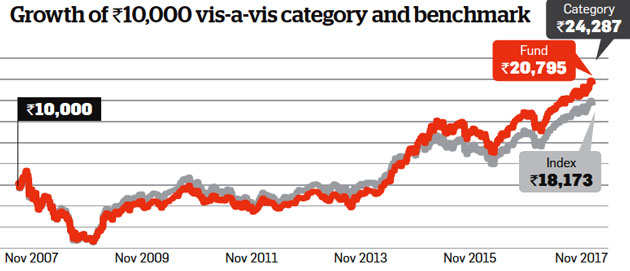

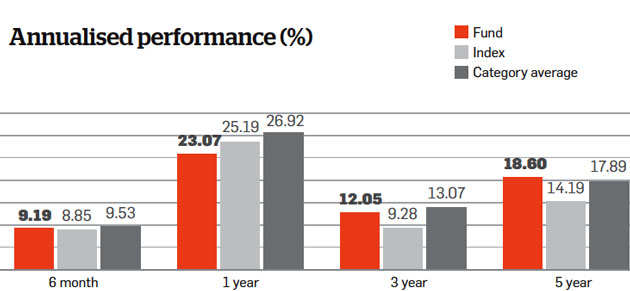

With a 10-year return of 7.6%, the fund has outperformed the benchmark (6.16%) but has significantly underperformed the category (9.28%).The fund's long-term track record is not very healthy.

BASIC FACTS

Date of launch : 22 Feb 2000

Category : Equity

Type : Multi Cap

Average AUM : Rs 671.29 cr

Benchmark : S&P BSE 200 Index

WHAT IT COSTS

NAVS*

Growth option : Rs 74

Dividend option : Rs 21

Minimum investment : Rs 5,000

Minimum SIP amount : Rs 500

Expense ratio (%)^ : 2.74

Exit load: 1% for redemption within 365 days

Date of launch : 22 Feb 2000

Category : Equity

Type : Multi Cap

Average AUM : Rs 671.29 cr

Benchmark : S&P BSE 200 Index

WHAT IT COSTS

NAVS*

Growth option : Rs 74

Dividend option : Rs 21

Minimum investment : Rs 5,000

Minimum SIP amount : Rs 500

Expense ratio (%)^ : 2.74

Exit load: 1% for redemption within 365 days

Fund manager : R. Janakiraman

Tenure: 4 years 6 months

Education: B.E, PGDM

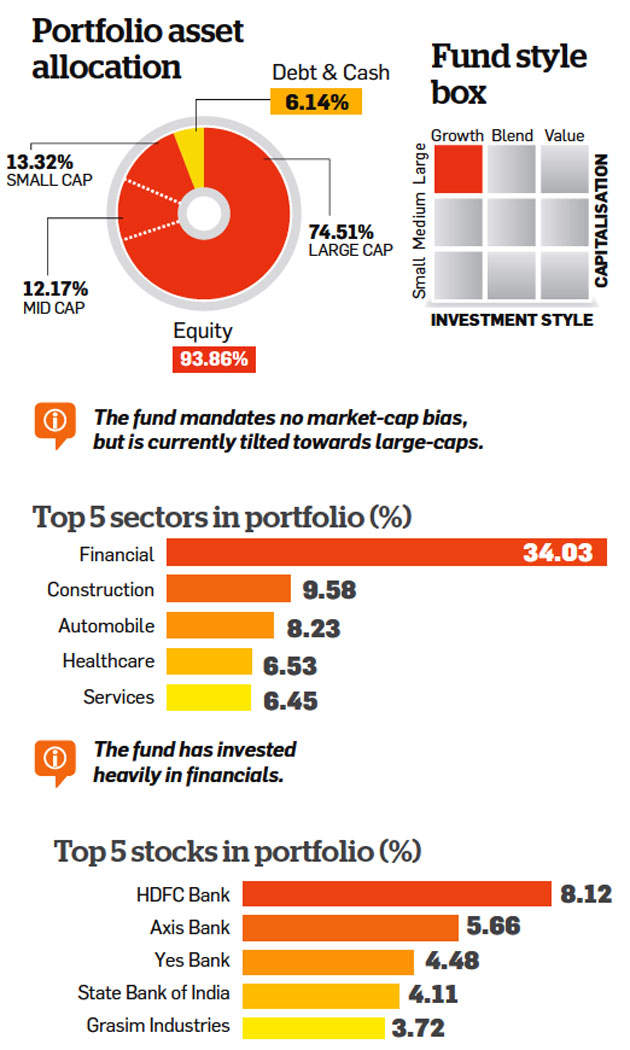

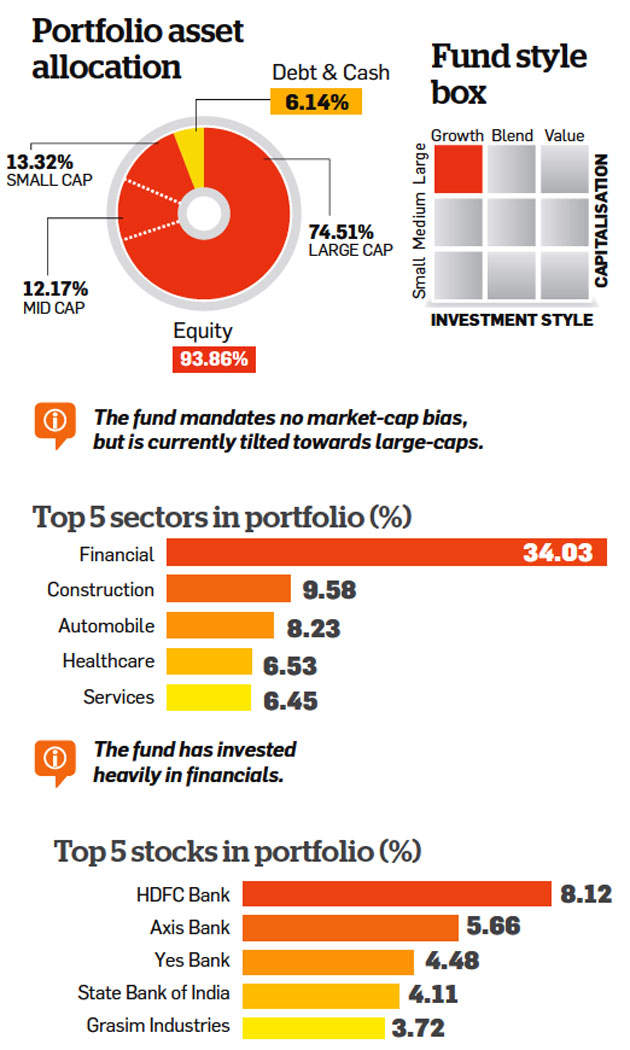

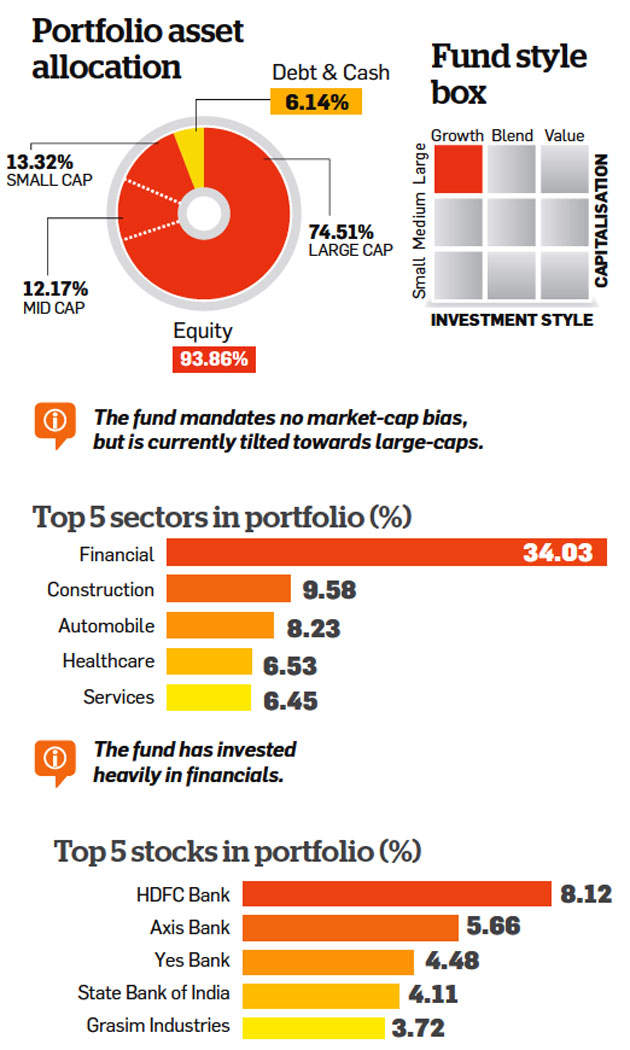

Where does the fund invest?

The fund's top picks are mostly from the banking space.

Tenure: 4 years 6 months

Education: B.E, PGDM

Where does the fund invest?

The fund's top picks are mostly from the banking space.

How risky is it?

The fund's risk-reward profile is below average.

The fund's risk-reward profile is below average.

Franklin India Opportunities Fund takes no particular market-cap bias, but is tilted towards large-caps and follows a broad investment mandate. Its long-term track record is patchy, with several years of underperformance since 2007, relative to peers in the same category. The portfolio is compact with healthy exposure in top bets. The fund manager is comfortable taking large positions in high conviction picks, and also picking stocks from outside the benchmark index.

However, the portfolio is heavily skewed towards the banking sector, with six of its top 10 stocks from this space. The fund's portfolio turnover has been consistently low in the past few years, indicating a strict buy-and hold approach. Given its weak return profile, other proven flexicap funds from the same fund house are better picks.

However, the portfolio is heavily skewed towards the banking sector, with six of its top 10 stocks from this space. The fund's portfolio turnover has been consistently low in the past few years, indicating a strict buy-and hold approach. Given its weak return profile, other proven flexicap funds from the same fund house are better picks.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment