Filing ITR every year is very important for every individual who is an assessee. While filing ITR, it is always better to keep few things readily available with you like - Aadhaar number, PAN Card, Bank details and other investment documents.

You can easily file your own ITR through e-filing portal using these 5 simple steps

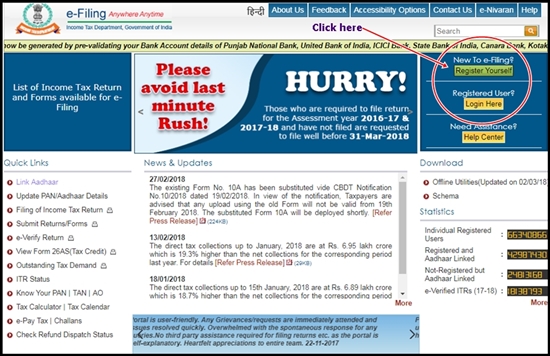

Step 1: Visit the e-filing website at https://incometaxindiaefill

Step 2: Once you will proceed towards the 'Registered User' tab and click on the 'login' virtual switch, you will be directed to the next window where you need to enter your User ID (which is your PAN number), password, date of birth and auto-generated captcha.

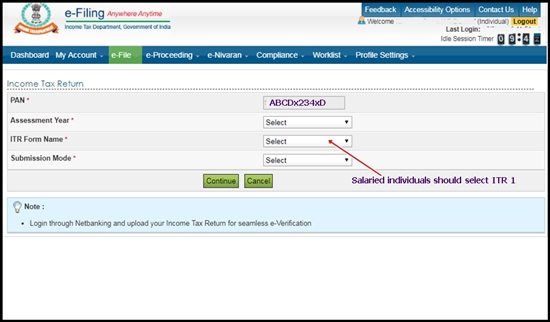

Step3: After entering all the credentials successfully, clicking on the login tab will proceed you towards a new window. Here you can view your previous/current history of ITR's and also, by clicking on 'filing of ITR' will help you proceed further taking you to a new window where you can file your new ITR.

Step 4: Now, when you are ready to file a new ITR, which you can do it very easily by your own ITR. You need to enter your PAN, select the assessment year, select the ITR form which you need to file (Salaried employees need to file details in ITR 1 (SAHAJ) in appropriate columns and finally select the mode of submission to proceed further filing your returns.

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment