Public Provident Fund (PPF) is still one of the best tax saving investments for risk-averse investors. PPF offers the triple benefits of tax saving, risk free returns and tax free returns. As per the provisions of the new Union Budget, investors can deposit up to Rs 1.5 lacs per annum in their PPF account, resulting in an annual tax saving of up to Rs 45,000/- for investors in the highest tax bracket. The PPF interest rate for the year 2014 – 2015 is 8.7%.

PPF is the best tax saving investment option for the risk-averse investor

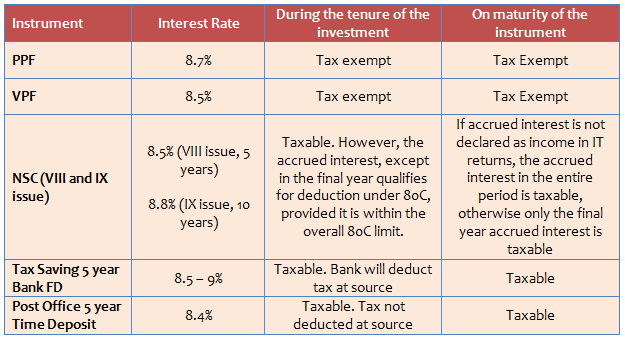

Though some tax saving investments offer similar interest rates, the taxability of returns have significant impact on the actual returns to the investor. Public Provident Fund and Voluntary Provident Fund are the most tax friendly fixed income investment options under Section 80C. The table below shows the tax treatment for various fixed income investment options under Section 80C.

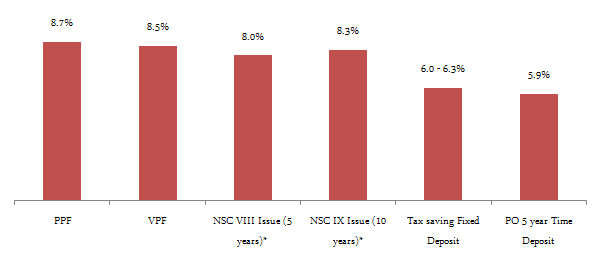

On a post tax basis PPF offers the highest returns among all tax saving fixed income investments. The chart below shows the annualized post tax return from various fixed income linked tax saving investment options under Section 80C.

PPF does not give fixed returns

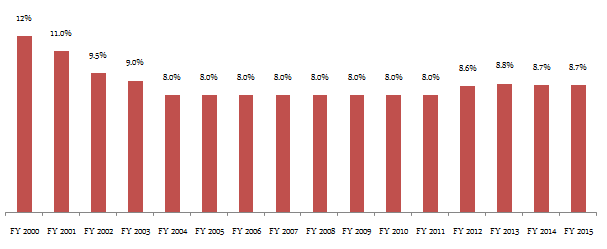

Though the Government changed the PPF interest rate from time to time, for a long period of time it had been fixed at 8%. Traditionally investors expected a yield of around 8% from their PPF deposits. However, from 2011 onwards, PPF interest rate has been made market linked and pegged with the 10 year Government bond yield. The chart below shows the historical PPF interest rates.

The benchmark 10 year government bond yield is at 8.8%, which is nearly at its 5 years historical high. Debt market experts consider 9% as the inflection point, since rates usually soften from this point. Interest rate in India has been high for a long period of time now and many experts believe that interest rates will start softening from next year. While a benign interest rate regime is good news for equity investors, since PPF interest rate is linked with the 10 year bond yield, we may see lower PPF interest rates in the future.

ELSS as a tax saving Investment

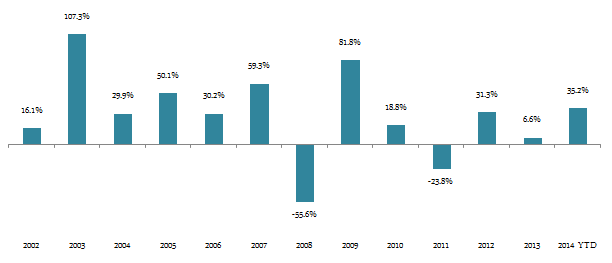

For investors with risk appetite, Equity Linked Saving Schemes (ELSS) is one of the most popular investments allowed under Section 80C. Investors can avail triple benefits of tax savings, capital appreciation and tax free returns in ELSS. An ELSS is essentially a diversified equity fund with a lock in period of three years from the date of the investment. From a taxability of returns perspective, both capital gains and dividends from ELSS are tax free. Over a long time horizon equities give much higher returns compared to other asset classes. However, since ELSS funds are market linked investments, they are subject to market risk and volatilities. Historically, good ELSS funds have given excellent returns. In the last ten years ELSS funds on average have given more than 19% trailing annualized returns. The chart below shows average historical returns of the ELSS funds category.

Comparison of PPF and ELSS returns

In the strict sense, it is not fair to compare PPF and ELSS. PPF is a risk free investment, whereas as ELSS is subject to market risks. For the sake of illustration we have shown the comparison of returns of Rs 50,000 annual investment in PPF and a good ELSS fund, over a long investment.

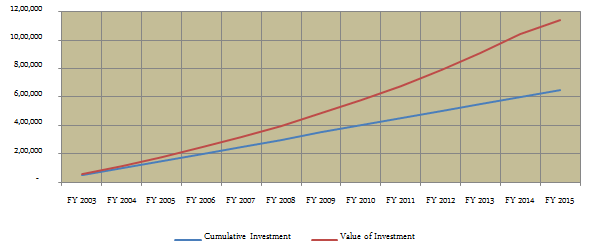

If you started an Rs 50,000 annual PPF deposit in 2002, your PPF corpus as on September 1 2014 will be Rs 11.4 lacs, with a cumulative investment of Rs 6.5 lacs. The chart below shows the PPF returns during the term of the investment.

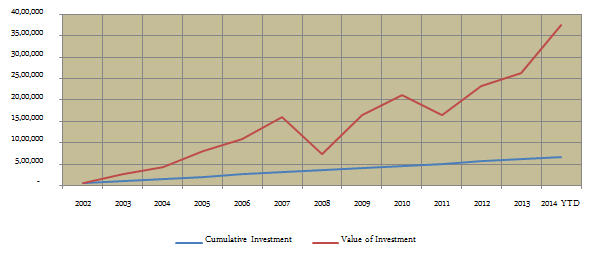

If you had started an Rs 50,000 annual investment in a top ELSS fund like the ICICI Prudential Tax Plan in 2002, your corpus will be Rs 37.5 lacs. The chart below shows the returns from the tax saver fund during the term of the investment.

Should you invest in PPF or ELSS

Both PPF and ELSS have their merits and demerits. Your investment choice should be informed by your investment objectives and your risk tolerance level. Your risk tolerance level is based on several factors (discussed in our article Measuring Risk Tolerance of Investors). Age and financial situation are certainly two important factors that determine risk tolerance of an investor.

- Investors with high risk tolerance should invest in ELSS, while investors with low risk tolerance should invest in PPF. Over a long time frame wealth creation potential is much higher with ELSS, as we saw in the charts above.

- Young investors should opt for ELSS, since they usually have high risk tolerance and a sufficiently long time horizon to ride out the volatilities associated with equity investments.

- If you do not have a PPF account and you are 15 or 20 years away from retirement, you should open a PPF account and start making regular deposits, so that you can accumulate a corpus by the time you retire. As you approach retirement, your risk tolerance goes down and PPF is a better investment option in such a situation.

- Investors with moderate risk tolerance level can invest in both PPF and ELSS in accordance with their optimal asset allocation strategy. You can read about some general asset allocation guidelines in our article, Asset Allocation strategies for different age groups.

- Salaried individuals are mandatorily required to contribute a portion of their salary to employee provident fund (EPF). The EPF interest rate is similar (slightly lower) to the PPF interest rate and the maturity amount is tax free. The EPF contribution of the employee goes towards the 80C tax savings. Therefore they should opt for ELSS, unless they are near retirement. Investment in ELSS through systematic investment plans (SIPs) over a long time horizon will help you both in tax planning and retirement planning.

- Self employed individuals should make regular PPF deposits for their retirement planning. It is a good idea to extend your PPF even beyond maturity in blocks of 5 years, if you do not need the liquidity immediately. You can continue to make deposits to your PPF. Even if you cannot make deposits every year, you can stay invested in PPF and your accrued balance will continue to earn tax free interest.

- Investment horizon is another important consideration, in deciding between PPF and ELSS. The tenure of PPF is 15 years with very limited liquidity during the term of the investment. If you have an investment horizon of 5 to 10 years for any specific financial objective, then you cannot rely on PPF. ELSS may be a good investment choice for a 5 to 10 year time horizon, provided it is suitable for your risk profile.

Liquidity Considerations

- The tenure of PPF is 15 years and is extendable in blocks of 5 years. While liquidity of PPF is lower than other tax saving fixed income investments, PPF does offer limited liquidity options through withdrawals and loans, during the term of the investment. Withdrawals not exceeding 50% of fourth year balance or 50% of the balance at the end of the immediate preceding year, whichever is lower, are permitted after a lock-in period of 7 years. PPF also offers loan facilities from third year onwards under special circumstances. The loans can be availed between third and sixth year, and should not exceed 25% of the balance second immediate preceding year. Rate of interest of the loan will be 2% more than prevailing PPF rate and the loan must be repaid in two years. The withdrawal and loan facilities notwithstanding, PPF is essentially a very long term investment. Investors must be prepared to wait for at least 15 years to get the maturity amount.

- ELSS has a lock-in period of three years from the date of the investment. In other words, investors will not be able to redeem their units for the first three years. If you invest in an ELSS through a systematic investment plan (SIP), each SIP investment will be locked in for three years from their respective investment dates. You can opt for both growth and dividend options. But you should not opt for dividend re-investment option, because the every dividend re-invested gets locked in for 3 years in an ELSS. So a portion of your dividend gets locked-in for ever. If you have opted for dividend re-investment in an ELSS fund, you can switch to the dividend payout option. Some mutual funds also allow investors to switch from dividend re-investment to growth option.

Conclusion

Both PPF and ELSS are wonderful tax saving investment options. However, their suitability depends on the financial objectives and the risk profiles of the individual investors. Investors should consult with financial planners or advisors to understand their individual risk profiles, and the most suitable tax saving investment options.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment