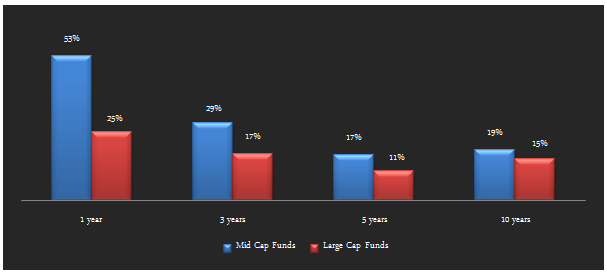

The last one year has been very good for midcap funds. Midcap funds have given generated significantly superior returns relative to large cap funds over the last one to three year period, as can be seen in the chart below (NAVs as on May 07, 2015).

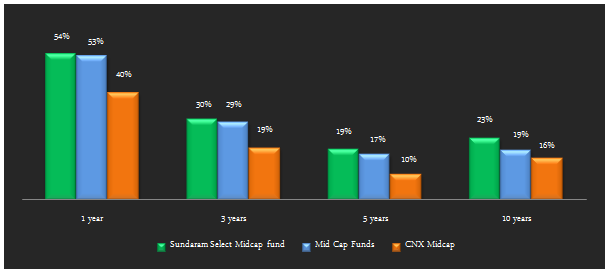

Last year we had reviewed the strong long term track record of Sundaram Select Midcap fund. The fund has continued its strong performance generating nearly 54% trailing returns over the last months. This is purely a mid-cap fund and has achieved capital appreciations through active re-balancing of sectors and stocks, to deliver excellent long term returns on investment. Sundaram Select Midcap fund has strong track record of outperformance. It is best performing midcap fund, along with Birla Sun Life MNC fund, in terms of ten years trailing returns. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between Sundaram Select Midcap fund, mid-cap funds category and the CNX Mid Cap Index (NAVs as on May 7)

Sundaram Select Midcap Fund – Fund Overview

This fund is suitable for investors with high risk appetites, looking for high capital appreciation over a long term. As such the fund is suitable for investors planning for long term financial objectives. However, investors should be prepared for high volatilities in the short term. Launched in 2002, the Sundaram Select Midcap fund has an AUM base of over र 2,900 crores with an expense ratio of 2.3%. The asset management company Sundaram AMC, incorporated in 1996, is a fully owned subsidiary of Sundaram Finance, one of the oldest NBFC's in India. As an AMC, Sundaram specializes in small and midcap funds. From 2007 to 2012 the fund was under the stewardship of Satish Ramanathan, one of the most renowned fund managers in the midcap sector. S.Krishnakumar has been managing fund since Satish exited from Sundaram in the middle of 2012. Krishnakumar has been with Sundaram since 2003, and has a good track record of fund management.

Portfolio Construction

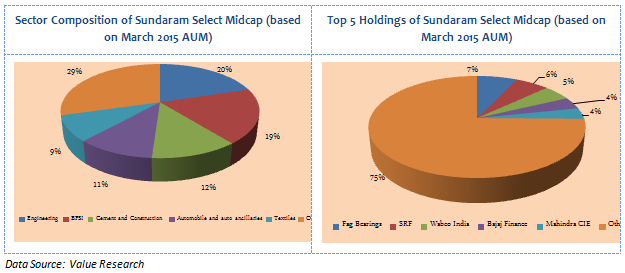

The fund selects good quality mid-cap stocks with stable cash flow and strong earnings potential. From a sector perspective, the portfolio has a pronounced bias towards cyclical sectors like Engineering, Banking and Financial Services, Cement and Construction, Automobiles and Auto Ancillaries etc. The portfolio is positioned to do well, when the capex cycle revives in the Indian economy. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, Fag Bearings, SRF, Wabco India, Bajaj Finance and Mahindra CIE Ipca Laboratories, Fag Bearings, Amara Raja Batteries, Bosch and Tech Mahindra accounting for only 25% of the total portfolio value. Even the top 10 stock holdings account for only 40% of the total portfolio value.

Risk & Return

In terms of risk measures, the volatility of returns is slightly on the higher side, relative to the midcap funds category as an average. Annualized standard deviations of monthly returns for three to ten year periods of the fund are in the range of 18 to 30%. The 5 year and 10 year standard deviations are higher than the category average. However, the last 3 years standard deviation is in line w ith the category. On a risk adjusted basis, as measured by Sharpe Ratio, Sundaram Select Midcap fund has however outperformed the category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See the chart below, for the comparison of Sharpe ratio of the fund versus the mid-cap category.

Comparison with Peer Set

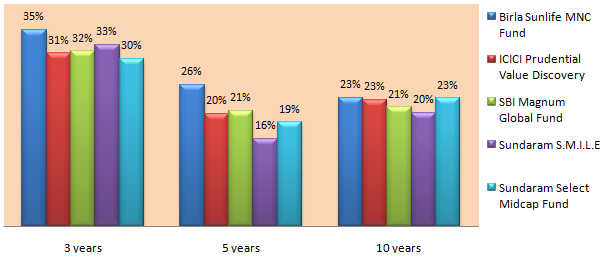

The chart below shows the comparison of the annualized trailing returns of the some of the best small and midcap funds over the last 10 years. Clearly Sundaram Select Midcap Fund's performance is right up there with its top performing peers.

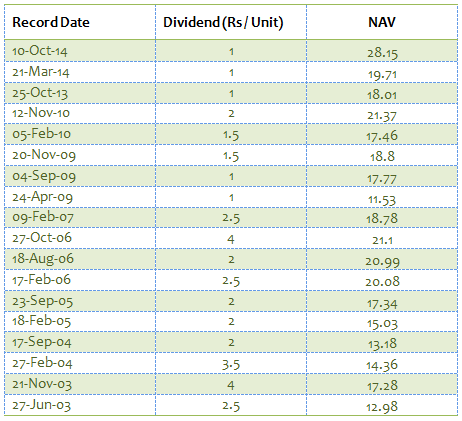

Dividend Payout Track Record

Sundaram Select Midcap Dividend Plan has a good dividend payout track record. Since inception in 2002, the fund has paid dividends every year, except for 3 years (2008, 2011 and 2012)

SIP Returns

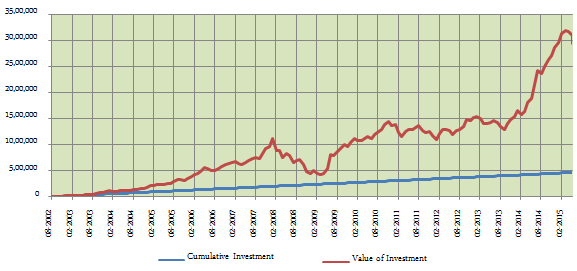

The chart below shows returns as on May 7, 2015 of र 3,000 monthly SIP in the Sundaram Select Midcap Fund Growth Plan, for respective years since inception (in July 2002). The SIP date has been assumed to first working day of the month.

The chart above shows that a monthly SIP of र 3000 in Sundaram Select Midcap fund since inception, would have grown to nearly र 30 lacs, with a total cumulative investment of only र 4.65 lacs. The SIP return of the fund since inception is 26.5%.

Conclusion

The Sundaram Select Midcap Fund has delivered over 10 years of strong and consistent performance. Though the recent performance of the scheme has not been as strong as its long term performance, the investment approach has the potential to generate long term capital appreciation. Investors can consider buying the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors can opt either for the growth plan or the dividend plan depending upon their individual financial plan. They should consult with their financial advisors if Sundaram Select Midcap fund is suitable for their investment portfolio.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment