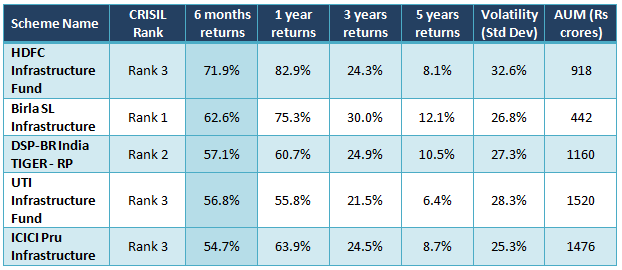

Infrastructure funds have made a strong comeback this year. Unlike diversified equity funds infrastructure funds are exposed to both systematic (i.e. market) and unsystematic (i.e. sector) risks. As such, only informed investors should invest in sector funds. It is important to get the timing of your entry and exit in such funds correct. Over 2 years or more, infrastructure funds had been lagging behind diversified equity funds for reasons that are well known. The rally in equity market leading up to the Lok Sabha election held in April - May, was riding on the expectation of a reversal of the policy paralysis situation that characterized the previous government. Stocks in the infrastructure sector have been among the biggest beneficiaries of the pre-election rally. The election results did not disappoint the market, with NDA and BJP getting absolute majority in the Parliament. Post elections, the structure of the new NDA government has been viewed by the market as one that will enable faster decision making and will kick start the stalled infrastructure projects. Consequently, post elections infrastructure funds have continued to perform well. Infrastructure funds category has given average return of over 58% in the last 6 months. For our selection of buzzing infrastructure funds, we have selected top 5 funds, based on the criteria discussed above. The buzzing funds in this category have given returns of over 60% in just the last six months. The table below shows the buzzing infrastructure funds (growth option).

Conclusion

As discussed earlier, investors should not rely purely on short term return as a performance measure, when selecting mutual funds for investment. Investors can add these buzzing funds to their investment watch-list. If these funds are able to sustain the strong performance they have shown this year to date in the future, investors should discuss with their financial Prajna Capital, if they are suitable investment options.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

No comments:

Post a Comment