Substitute your RD with SIPs in Income funds

If you were asked to name an investment option that will allow you to put small sums on a regular basis, recurring deposits of banks would be the one on top of your mind. Small monthly sums, interest compounded quarterly at FD interest rates, no TDS and a lump sum at the end of the tenure – it's all a neat proposition, no doubt.

But did you know that the returns turn out to be not so lucrative once the taxman takes a slice off your interest income pie? Yes, post-tax returns of recurring deposits (RD interest is very much taxable, in case you thought otherwise) can be quite unattractive. But here's a good supplement that not only generates better returns over the long term but is far more tax efficient.

Welcome to the world of income funds – a class of debt mutual funds.

Suitability

If you had a minimum of 2-3 year investment time frame and wish to invest small sums regularly, a systematic investment plan (SIP) in income funds would be a good option. Income funds invest in a diverse basket of debt instruments that include certificates of deposits of banks, treasury bills, commercial papers, bonds and debentures of top-rated companies as well as government securities (called gilts).

That means they provide exposure to myriad debt instruments with varying risk-return profile and maturity. Income funds try to get the best of the underlying instruments by shifting their portfolios in line with interest rate cycles.

Even as they generate accrual income (which comes from holding the instrument till its maturity), they also seek capital appreciation by selling instruments when prices rally. This is one reason why their return potential is enhanced when compared with traditional debt products.

Income funds are also highly liquid, unlike RDs. They allow you to withdraw money any time you seek to.

Yes, income funds are market linked. That means their returns are not guaranteed or fixed, the way your recurring deposit interest is. It also means that their risk profile is higher than RDs.

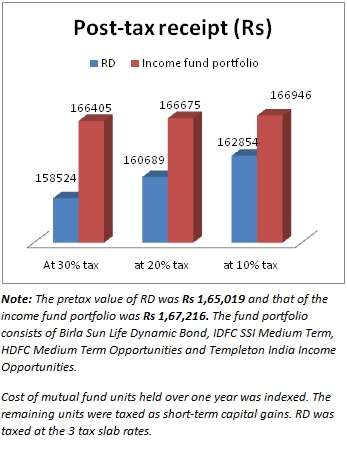

But just to illustrate the kind of returns they generate, we took a 3-year monthly RD (invested 3 years ago at the rate of 8.75% prevailing then) and compared it with an SIP in the income funds from Select funds' list. We took a period of 36 months ending June 30, 2013.

On the face of it, the difference in the final sum you receive will not seem very high at about Rs 2000. The pre-tax IRR works out to 9.9% for our portfolio against 9.1% for RD.

But take a look at the post-tax returns in each tax slab – 10%, 20% and 30% in the graphic below. The gain in our portfolio is about Rs 8000 at the highest tax slab and Rs 4000 at the lowest.

Tax advantage

The above difference arises as a result of a key tax benefit available to debt funds – capital gains indexation benefit for units held more than a year. Simply put, if you held debt fund units for over one year, you are allowed to bring your cost of those units to the present value, using the cost inflation index declared every year.

The gain, post indexation, is taxed at 20%. Investors also have an option to simply pay a 10% tax on the gains without indexing the cost.

Units held for less than a year alone are taxed at your income tax slab rate.

As against this, all interest incomes from deposits are taxed at your slab rate. There is no capital gain benefit available to deposits. As a result, investors, especially in the higher tax bracket, benefit immensely on the tax front when they invest in instruments such as debt funds that enjoy capital gain benefits.

In a highly inflationary scenario the indexed cost is often higher than even the market value resulting in a notional capital loss. That means you do not get to pay any tax and the loss can be set off against any other long-term capital gain.

In the illustration provided, the units held for more than one year did not suffer any long capital gains tax as a result of a notional capital loss (although in reality you gained quite a good sum).

Liquidity, tax efficiency and superior returns make income funds a good supplement to RDs. If you are simply a RD investor, take a third of your monthly surplus kept aside for RD and start an SIP in an income fund. That way you will have a good mix of a guaranteed fixed return product like RD and at the same time, a better yielding product called income funds.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs

No comments:

Post a Comment