A term plan is a straightforward protection policy and is the purest form of Life Insurance. Term plans, unlike endowment or money back plans, do not have savings and investment component built into the insurance policy. However, for the same sum assured, the premiums of endowment and money back plans are many times higher than term plans. We had discussed in our previous articles on life insurance that endowments and money back plans usually give a return of around 6% per annum, which is very low relative to other investment options like mutual funds. Financial planners often advocate combination of term plans and mutual funds, as better long term insurance and investment options compared to traditional endowment and money back plans. But what about Unit Linked Insurance Plans (ULIPs)? In this article, we will discuss, how a combination of term plan and mutual fund compare against a ULIP.

Before we discuss ULIPs, let us quickly discuss with the help of an example, why a combination of term plan and mutual fund is better than endowment plan. Let us assume you are 30 years old and your annual investment budget in Rs 1 lakh. With Rs 1 lakh annual premium in an endowment plan, you will get an insurance cover or sum assured of around Rs 20 lakhs. The premium rate is representative of LIC (New Endowment Plan) and SBI Life (Shubh Nivesh) endowment plans. Some online plans may be a little cheaper, but will make no meaningful difference to our analysis. Let us assume you take a 20 year plan. How much will you get on maturity? At a 6% annual rate of return, your maturity amount will be about Rs 36 lakhs. What if you had bought a term plan and invested the rest in the systematic investment plan (SIP) of a good diversified equity fund? The annual premium for Rs 50 lakhs sum assured in SBI Life Smart Shield, 20 year term plan is around Rs 7,200. Let us assume you invest the balance amount of your annual investment in monthly SIPs of Rs 7,700 (around Rs 92,800 annual) of a good diversified equity fund. SIPs in good diversified equity funds like HDFC Equity Fund, Franklin India Prima Plus, SBI Magnum Multiplier fund etc have given 15 – 20% returns in the last 15 years Even if we assume, 15% annualized return from your mutual fund investment, your total corpus at the end of 20 years is Rs 1.16 crores. Therefore, with combination of term plan and mutual fund, not only you a get much higher life insurance cover or sum assured, but for the same investment, you will get many times higher returns, as compared to an endowment plan. Some insurance advisers may question about tax savings? Insurance premiums are eligible for tax savings Section 80C. You can get Section 80C tax savings also for mutual funds, if you invest in Equity Linked Savings Schemes (ELSS). Good ELSS funds have also given excellent long term SIP returns In our article, Taking term plan can be a smart Insurance choice, we have discussed in greater details, why a combination of term plan and mutual fund is better long term investment option compared to traditional endowment and money back plans.

Let us now, come to main point of the article. How do ULIPs fare against the combination of term plan and mutual fund? This is a far more interesting contest, than the earlier one between traditional endowment plans and the combination of term plan and mutual fund, which was virtually a no brainer in the favour of term plan and mutual fund. As we know, ULIPs are combined insurance cum investment products. However, unlike traditional endowment and money back plans, ULIPs are market-linked and have the potential to deliver higher returns compared to endowment plans. On the flip side, ULIPs, unlike endowment plans which offer capital safety, are often prone to mis-selling. Aggressive mis-selling made ULIPs the most controversial investment product in our recent history. Under the revised IRDA guidelines the ULIP fees have been revised and ULIPs are now much more attractive as investment option. In addition to life cover, the investors may choose between equity and debt allocations of their premiums in ULIPs. In many ways, ULIPs are similar to a combination of term plan and mutual fund. In terms of gross investment returns ULIPs have performed comparably with mutual funds over a 5 year period. However, net returns to investors would be very different due to various applicable charges, which we will discuss in greater details:-

Premium allocation charges:

This is a percentage of the premium to be deducted upfront, before the units are allotted. This charge normally includes initial and renewal expenses apart from commission expenses.Policy administration charges

These are the fees for administration of the plan and levied by cancellation of units. This could be flat throughout the policy term or vary at a pre-determined rateMortality charges:

It is the fee for your insurance cover. It depends on the age of the investor and the amount of cover. ULIPs fix mortality cost at each life stage during the policy term. As you grow older, the risk that the insurer takes on you increases and so the mortality cost, too, increases proportionately.Fund Management charges:

These are fees levied for fund management and are deducted before arriving at the Net Asset Value (NAV)Surrender charges:

If you are unable to pay the premium within the lock in period of 5 years, then surrender charges would apply for encashment of the units

Let us now compare the two options, combination of term plan and mutual fund versus ULIP, by continuing with our earlier example. To recap, let us assume you are 30 years old and your annual investment budget in Rs 1 lakh. Let us review the investment option of term plan and mutual fund:-

- 20 year Term Plan with a sum assured of Rs 50 lakhs. The annual premium is Rs 7,200 (as discussed earlier).

- Monthly SIP of Rs 7,700 in a good diversified equity fund. The annual investment is Rs 92,800.

- The total annual spend of the investor in the term plan and the mutual fund is Rs 1 lakh.

- Assuming an annualized return of 15% from the mutual fund investment, the total corpus at the end of 20 years is Rs 1.16 crores (as discussed earlier).

Let us assess, how much return you can expect, if you invested Rs 1 lakh annually in a unit linked insurance plan (ULIP) over a 20 year term. For the purpose of making a like to like comparison, let us assume you opt for a sum assured of Rs 50 lakhs. Let us also assume that the Rs 1 lakh annual premium is paid in equal monthly amounts of Rs 8,333. Further, let us assume the annualized 20 year return from ULIP is the same at 15% (same as the annualized return from the mutual fund). In order to estimate how much return you can get at the end of 20 years, we need to make a few assumptions regarding the various ULIP charges. While our assumptions are broadly based on different plans available in the market, investors should note that these charges differ from plan to plan, and therefore they should read the product brochures of the ULIPs very carefully to understand these charges.

Premium allocation charges

have been assumed to be 4% of the premium for the first five years of the policy and then nil from sixth year onwards. On a monthly premium of Rs 8333, premium allocation charge will be Rs 333.Policy administration charges

have been assumed to a flat 3% of the premium through-out the term of the policy. On a monthly premium of Rs 8333, policy administration charge will be Rs 250.Mortality charges

have been assumed to be Rs 1.7 per Rs 1,000 of sum assured per annum from the age of 30 to 40 years. For a cover of Rs 50 lakhs, the mortality charge will be Rs 8,500 per annum or Rs 708 per month for the first 10 years. From the age of 40 to 50 years, the mortality charges have been assumed to be Rs 2.4 per Rs 1,000 of sum assured per annum. For a cover of Rs 50 lakhs, the mortality charge will be almost Rs 12,000 per annum or Rs 1000 per month for the next 10 years.Fund management charges

are applicable to both mutual funds and ULIPs. NAVs of both mutual funds and ULIPs are calculated after deducting the fund management charges. We should note that, fund management charges of ULIPs are capped by regulations at 1.35%, whereas in the case of mutual funds it can go up to 2.5%. Even though the fund management charges of mutual funds are slightly higher, the returns of top performing equity oriented mutual funds and ULIP funds (before the deduction of other charges discussed above) have been nearly the same over the last 5 to 10 years. Therefore, as discussed earlier, we have assumed the same annualized return from the mutual fund and the ULIP. Experts say, while mutual funds have higher fund management charges, they are more actively managed as compared to ULIPs. We will revisit this point later in the article.

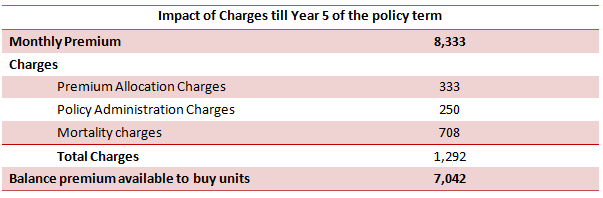

Premium allocation charge is deducted upfront from the unit, while policy administration charges and mortality charges are deducted by cancelling units on the basis of prevailing NAVs at the end of the month. In effect, the units will be allotted to you after deducting these charges from your monthly premium. As discussed earlier, you will pay a monthly premium of Rs 8,333. Let us see much of the premium goes these charges and how much goes towards investment, in the first five years.

Here you can see that after deduction of all the charges, only Rs 7,042 is left to buy units. This is where ULIP puts you at a disadvantage compared to the combination of term and mutual fund. In the option of a combination of term plan and mutual fund, the monthly SIP was Rs 7,700. Since the investment in ULIP units is lower by around Rs 650 every month, the value of your ULIP investment at the end of 5 years will be lower by Rs 62,000 compared to your mutual fund SIP investment.

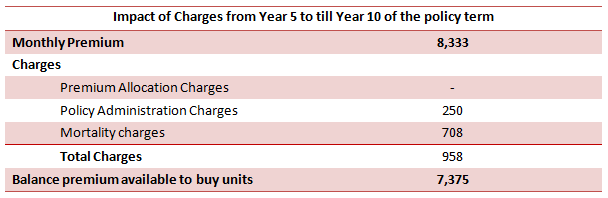

Based on our assumptions, from sixth year onwards the premium allocation is nil. Let us see much of the premium goes these charges and how much goes towards investment, from sixth year to tenth year of the policy term.

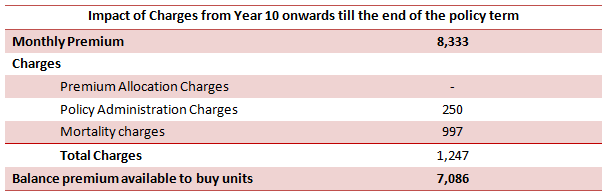

From the tenth year of the policy, the mortality charges will go up, since the insured will be 40 years of age. Let us see much of the premium goes these charges and how much goes towards investment, from tenth year onwards till the end of the policy term.

We can now calculate, what your maturity amount will be:-

- By the end of year 5, your corpus will be Rs 6.24 lakhs. However, if you surrender the policy at this point of time, surrender charges will apply and your actual corpus will be slightly lower.

- By the end of year 10, your corpus will be Rs 19.68 lakhs

- By the end of the policy term, your maturity amount will be Rs 1.08 crores

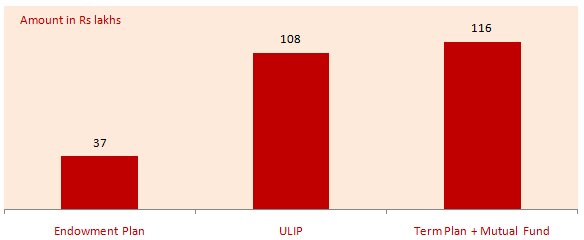

You can now see, why we had earlier said that the contest between the combination of term plan and mutual fund versus a ULIP is more interesting, than the contest between the combination of term plan and mutual fund versus a traditional endowment plan. The chart below shows the maturity amounts for Rs 1 lakh annual investment over 20 years in all these three options.

The combination of term plan and mutual fund still comes out on the top. The total corpus is Rs 8 lakhs more than ULIPs. But the difference is closer than some of us would have imagined.

What if ULIP returns were higher than mutual funds?

We had discussed earlier that the fund management charges of ULIPs were lower than mutual funds. If the ULIP returns are higher than mutual funds by 1% or more, then they can match or even beat the combination of term plan and mutual fund, in terms of returns, based on the assumptions made in our analysis. While returns of different ULIP funds and mutual funds are different on a case by case basis, there is no historical evidence that ULIP funds on average can beat mutual funds in the long term. Furthermore, if the ULIP charges are higher than what we have assumed in this analysis (and in many cases they are indeed higher), then even in the scenario where ULIP funds give higher returns, the actual returns for the investor may be lower compared to that of the combination of term plan and mutual fund.

Conclusion

In this article, we have compared the return given by a combination of term plan and mutual fund with that of ULIPs. Based on our analysis, a combination of term plan and mutual fund can give higher returns than ULIPs. However, the difference is narrow, and therefore it is important that investors evaluate various plans carefully before making their investment decision. If you have already invested in ULIPs and have crossed the stage when the charges were high, you may consider remaining invested in the ULIP, if the fund you are invested in is doing well. Either ways, investors should discuss various considerations in selecting between different insurance and investment products with Prajna Capital and decide on the best insurance and investment option.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment