Retirement planning is one of the most important aspects of financial planning. The fundamental goal of retirement planning is to achieve financial independence in your retirement years. The other important retirement planning goal is to be able to maintain your current lifestyle even during your retirement years. Retirement planning is a very structured process, the first step of which is to calculate your retirement needs. We had discussed, in the previous article of our retirement planning series, we have seen how we can calculate our retirement needs. Please see our article, Retirement Planning: Calculating Your Needs. This is an important step through which we can estimate, how much corpus we need at the time of retirement to sustain our current lifestyle. The next step of the retirement planning process is to determine, how we will build the retirement corpus.

There are three factors that are critical in determining how much we need to save, to build our retirement corpus. These two factors are:-

- Our time horizon to retirement

- Our risk tolerance, which is linked with our time horizon

- current net worth, in terms of financial assets

We will discuss each these factors in this article, to develop a structured process for retirement planning. As discussed in our previous article, Retirement Planning: Calculating Your Needs, retirement planning is a dynamic process. You should revisit retirement planning from time to time to see if your retirement plan is on track and aligned with the three factors discussed above, at that stage of your life.

Time Horizon to retirement

As with most things in life, starting early has great benefits. The earlier you start the better are the chances for creating wealth as you get more time on to earn higher returns on your investments. This is because the returns you earn on your investment, in turn generate returns over time. This is known as the compounding effect. However, most people do not follow this and start investing when they are married or have kids without realising that they are already late. The compounding effect is based on the principle of compound interest. Compound interest is the concept of adding earned or accumulated interest back to the principal amount, so that interest is earned on top of interest from that period onwards. The act of adding declared interest to be principal is called compounding. How much is the compounded returns? You will recall the old compound interest formula that we learnt in secondary school mathematics.

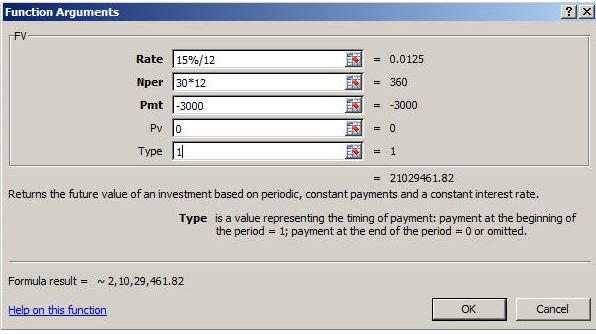

Here, P is the investment amount, R is the annual return and n is the time horizon. Needless to say, the earlier we start saving for retirement, larger the retirement corpus. Let us now discuss the effects of saving and investing for retirement on a systematic basis. If you save a fixed amount every year and invest it then each of your systematic investments with compound till the time you retire, and you will build a substantial retirement corpus at retirement. There is a Microsoft Excel formula, that can help us calculate the amount of corpus created at the end of the investment horizon (e.g. retirement) if we systematically save and invest a fixed sum on a regular basis. The Excel formula is Fv. Fv or (future value) has four arguments or parameters. They are Rate, Nper, Pmt, Pv and Type.

Rate is the rate of return you expect to earn on your investment. When we input the rate in the formula, it is important to keep in mind the frequency of your investment. If you are investing on a monthly basis, then you should use monthly returns. If you are investing quarterly, then you should use quarterly returns and so on. In this example, we have assumed that we are investing on a monthly basis in a systematic investment plan (SIP). The annual rate of return is assumed to be 15%. Therefore to get the monthly return, you need to divide it by 12, as shown in the screenshot above.

Nper is the number of periods in which you will invest. Again the frequency of investing is important here. Let us assume, the time horizon to retirement is 30 years. Since we are investing on a monthly basis, we will have to multiply the time horizon by 12, as shown in the screenshot above.

Pmt is the systematic investment payment you will make every month. In excel, you will have to input this as a negative number. In our example, we have assumed the SIP amount to be Rs 3000 per month. So we will input -3000 for Pmt.

Pv is the current value of your investment, assuming you have already started your SIP. In this example, we have assumed that we have not yet started the SIP, and so the Pv is zero. But if you have already started your SIP, you can enter the value, based on your most recent account statement

Type tells the formula, whether the systematic payments are made at the beginning of the period (month in our example) or at the end of the period (month in our example). In our example, we have assumed that SIP payment is made at the beginning of the month.

The future value (at the time of retirement) is shown near the bottom left hand corner, in Formula result. Thus we can see that, if we save and invest Rs 3000 a month over 30 years and get an annualized return of 15%, our corpus will be around Rs 2.1 crores. Therefore, you can use this formula to determine how much retirement corpus you can create, based on how much you can invest on a monthly basis.

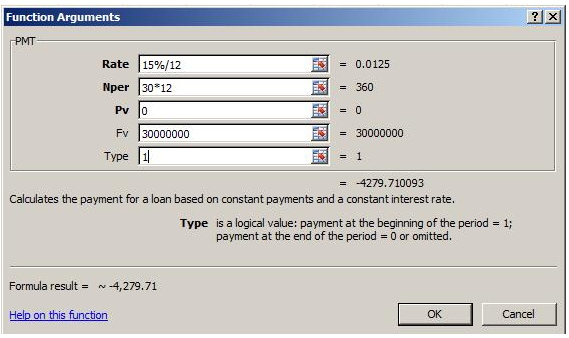

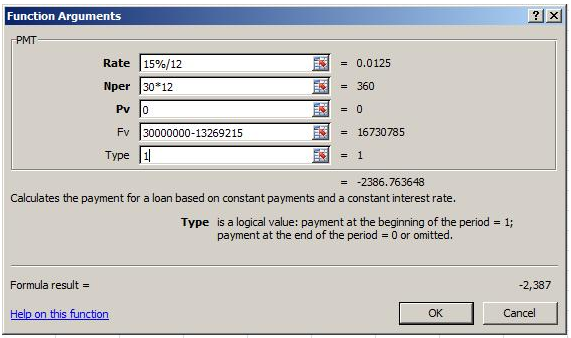

If you have already determined a corpus that you need, based on the methodology discussed in our article, Retirement Planning: Calculating Your Needs, then you can use another Microsoft Excel formula to determine how much you need to save every month. This Excel formula is Pmt, which is no different from the argument "Pmt" we saw in the FV formula. It is self evident, that the formula Pmt has four functions, Rate, Nper, FV, Pv and Type.

Rate, as discussed above, is the rate of return you expect to earn on your investment, depending on the frequency of your investment. In this example, we have assumed that rate of return is 15% and that we are investing on a monthly basis.

Nper, as discussed above, is the number of periods in which you will invest depending on the frequency of investing. As discussed in our example, since the time horizon to retirement is 30 years and we are investing on a monthly basis, we will have to multiply the time horizon by 12.

Pv, as discussed above, is the current value of your investment, assuming you have already started your SIP. In this example, we have assumed that we have not yet started the SIP, and so the Pv is zero.

Fv is the future value of your systematic investments. For our purpose, it is the amount of retirement corpus, you want to accumulate. Let us assume we want to accumulate a retirement corpus of Rs 3 crores, as shown in the screenshot above.

The monthly systematic investment is shown as a negative number, near the bottom left hand corner. So if you want to accumulate a corpus Rs 3 crores by the time of your retirement, you need to invest around Rs 4,280 per month, assuming you get 15% annualised return on your investment.

So, which formula should you use to determine, how much you need to save? Well, you may have to use both. Why? In case, you have already determined, how much retirement corpus you need, then you should use the Pmt formula. If you are able to save and invest the amount, as suggested by the Pmt formula, then you are all set for the next step of your retirement planning process. On the other hand, you may not be able to save and invest the amount as suggested by the formula because of your personal financial situation. Do not despair, especially if you are young, because your income will increase over time and you will, most likely, be able to catch up later. You should determine yourself, the maximum amount you can save and use the Fv formula to calculate how retirement corpus you will accumulate at your current rate of savings. You should also note the delta (or difference) between the corpus that you will accumulate at your current rate of savings and the corpus that you will ideally need for retirement. Remember, that you will have to ramp up your savings rate later, to catch up.

Risk Tolerance

Risk tolerance is another important factor in your retirement planning process. Risk and returns are directly correlated. The more risk you take, higher the returns. Your asset allocation will depend upon your risk tolerance level, and that will ultimately determine your return on investment. At the cost of repetition, we should reiterate that, equities as an asset class give much higher returns compared to other asset classes. Equities are also more risky, compared to other asset classes. As discussed earlier in this article, risk tolerance is a function of the investment horizon. If you have a long time horizon, you can ride out the volatility associated with equity investing. Please see our article, How Mutual Fund SIPs have created wealth over the last 15 years: Large Cap and Diversified Equity. On the other hand, if you have a shorter time horizon, then you need to be more conservative, with regards to your asset allocation. The following guideline can be used to determine risk tolerance

- Low Risk Tolerance: Time Horizon less than 5 years

- Medium Risk Tolerance: Time Horizon between 5 to 15 years

- High Risk Tolerance: Time Horizon more 15 years

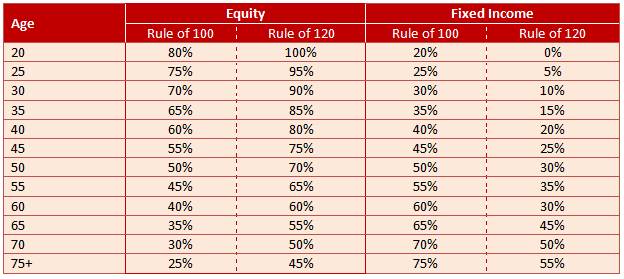

There are several asset allocation strategies, based on the investment horizon. Please see our article, Asset Allocation strategies for different age groups. The Rule of 100, gives us asset allocation for various age-groups.

However it is important to note that, investment horizon is not the only determinant of our risk tolerance levels. Risk tolerance depends on the personal financial situation of the investor, which includes a variety of factors like:-

- Income and Expenses of the investor

- Liquid (cash savings) of the investor

- Short term financial goals

- Insurance cover (both life insurance and health insurance) of the investor

If for example, if you have high level of disposable income and you have a high level of liquid savings, then you can afford to take more risks than what the above rules suggest. You can read our article, Measuring Risk Tolerance of Investors, for an objective perspective on risk tolerance

Your risk tolerance level will influence your asset allocation strategy, which in turn will determine your return on investment. At this point, we should recap the twin benefits of starting your retirement planning early.

- You have a longer investment horizon, which will enable you to benefit from the power of compounding

- You will also be able to take more risks in you asset allocation, since your risk tolerance will be lower. Therefore, your return on investment will also be higher

Let us revisit the formula of compounding.

Since both R and n will be higher if you start earlier, you will have a big advantage or head start as far as your retirement planning process is concerned.

Investors with high risk tolerance should invest in equity funds and then progressively shift to balanced funds and debt funds, as they get nearer to retirement. There are mutual funds that allow investors to opt for flexible allocation to equity or debt, based on the risk tolerance level of the investor. Investors should consult with their financial advisers, with regards to their asset allocation strategies for retirement planning, and suitable investment options related to it.

Current Financial Assets

If you have financial assets, your retirement planning effort becomes simpler. However, we need to get the definition of "assets" very clear. From a finance perspective, assets are items that generate current or future cash flows. If it does not generate current or future cash flows, it is not an asset. Therefore, we should consider only financial assets here. If you have financial assets, you should project their value at retirement, based on the appropriate projected ROI, depending on the asset class.

Equity investments, in general, have given 15 – 20% returns over the long term (10 years and more). However, you need to be careful about the nature of your equity investment. Are these shares of a company or companies? Are these large cap companies or mid cap companies? Is your equity investment in mutual funds? Are they large cap funds, diversified equity funds or midcap funds? You should note that, if you are investing directly in shares of a company or companies, you will be exposed to both systematic and non-systematic risks, unless you have a sufficiently diversified portfolio of shares. Systematic risk is "undiversifiable risk" or market risk. Non-systematic risks are company specific or sector specific risks. Mutual funds on the other hand, aim to diversify to a large extent the non-systematic risks. If you are invested in mutual funds, you should check if you are invested in a top performing fund. If you are invested in debt or fixed income investment, then you can assume a net return of 6 – 10%, depending on the instrument. Either ways, do not ignore the impact of taxes. Long term capital gain in equity funds is tax exempt. In the case of debt funds, long term capital gain is taxed at 10% without indexation and 20% with indexation. If you are invested in fixed deposits, then the interest is fully taxable.

If you are invested in both debt and equity, how will you calculate your rate of return? You will have to use the weighted average formula.

Rp = Re X We + Rd X Wd

Here Rp is the portfolio return, Re is the return on equity investment, We is the percentage of the portfolio allocated to equities, Rd is the return on debt or fixed income investment and Wd is the percentage of the portfolio allocated to debt.

If for example, 60% of your current financial asset is invested in equity and 40% to debt, and if the return on equity is 17% and return on debt is 9%, then the portfolio return is:-

Rp = 60% X 17% + 9% X 40% = 13.8%

Let us assume your current investment is Rs 3 lakhs, 60% in equity and 40% in debt. If your time horizon to retirement is 30 years, assuming the ROIs on equity and debt are 17% and 9% respectively, the projected value of your current investment will be:-

Future Value = 300,000*(1+13.8%) ^20 = 1,32, 69,215

When you calculate, how much you need to save for retirement, you can subtract this amount from your retirement corpus or Fv in our example, discussed above.

Assuming you have Rs 3 lakhs in financial assets in the asset allocation proportion discussed above, let us calculate how much you need to save on a monthly basis, over a 30 year time horizon to retirement, to accumulate a corpus of Rs 3 crores. The annualized rate of return of your SIP is 15%.

Rate, as discussed earlier, is the rate of return you expect to earn on your investment, depending on the frequency of your investment. In this example, we have assumed that rate of return is 15% and that we are investing on a monthly basis.

Nper, as discussed earlier, is the number of periods in which you will invest depending on the frequency of investing. As discussed in our example, since the time horizon to retirement is 30 years and we are investing on a monthly basis, we will have to multiply the time horizon by 12.

Pv, as discussed earlier, is the current value of your investment, assuming you have already started your SIP. In this example, we have assumed that we have not yet started the SIP, and so the Pv is zero.

Fv, as discussed earlier, is the future value of your systematic investments. For our purpose, it is the amount of retirement corpus, you want to accumulate. Let us assume you want to accumulate a retirement corpus of Rs 3 crores. Since, the future value of your current financial assets at the time of retirement is Rs 1.33 crores as discussed above, we need to accumulate only the balance amount, Rs 30000000 - 1326921, as shown in the screenshot above.

The monthly systematic investment is shown as a negative number, near the bottom right hand corner. So if you want to accumulate a corpus Rs 3 crores by the time of your retirement, and you already have Rs 3 lakhs of investments, you need to invest only around Rs 2,386 per month.

It is obvious that, higher the future value of your current financial assets, the better off you are, from a retirement planning perspective. How can you increase this number? You can increase this, by shifting to a more aggressive allocation to equities, for your current financial assets. But bear in mind your risk tolerance.

Conclusion

In this article, we have seen how much we need to save to meet our retirement needs. Retirement planning is one of the most important aspects of financial planning. The earlier we start saving for retirement, the easier the task becomes, due the effect of compounding. We should give a lot of careful consideration to retirement planning. Retirement is an important phase of life. By planning for it, we can make retirement, the golden years of our lives.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment