We are already in the third month of this financial year. Unless you have already started your tax planning, now is a good time to start planning for tax saving investments for the year FY 2016 – 2016. Remember, the longer you wait for start your investment, the more you will lose out on returns. In this article, we will evaluate the post tax returns of some of the popular fixed income tax saving investment options. The fixed income investment options that qualify for deduction under Section 80C of Income Tax Act are as follows:-

- Voluntary Provident Fund (VPF)

- Public Provident Fund (PPF)

- National Savings Certificates (NSC)

- 5 year Post Office Time Deposits

- 5 year Tax Saving Bank Fixed Deposit

Employee Provident Fund (EPF) also qualifies for tax saving under Section 80C. Your employer deducts your contribution to your PF account from your monthly pay cheque (12% of your basic salary). The annual interest earned on your PF savings is 8.5%. Please note that, this will have to be shown as a deduction under Section 80C in your Income Tax Returns. Therefore the balance amount left after deducting your EPF contribution from Rs 1 lakh is what is available for your tax saving investments under Section 80C. Let us now discuss the other investment options available to you.

There are 3 important considerations when evaluating fixed income investment options under Section 80C.

- Interest Rate

- Tax treatment

- Liquidity

Interest Rates

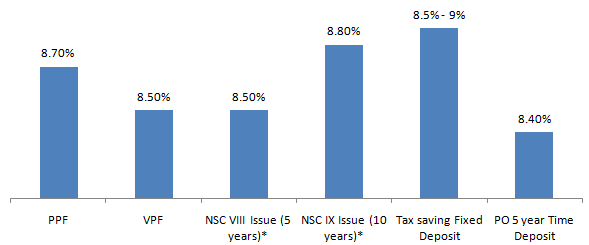

The interest rates offered by these instruments are fixed from time to time by the Government or the banks. The chart below shows the interest rates of these instruments.

We can see that Bank FDs, 10 year NSC and PPF offer higher interest rates, compared to other instruments. The interest rate of Post Office 5 year time deposit is the lowest at 8.4% (in fact, it was even lower in the prior financial year). At first glance to less discerning investors, the difference in interest rates may seem small. But for investors with a long time horizon, a 20 – 30 bps difference in interest rate on a compounded basis can add up to a not so insignificant amount. However, investors should not make investment decisions based on interest rates alone, because tax treatment makes a big difference to the final returns.

Tax Treatment

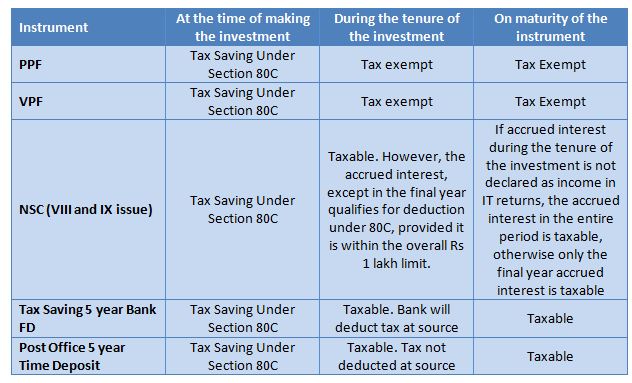

To fully evaluate the impact of taxes on these instruments, one must understand the tax treatment at three different stages of investment:-

- At the time of making the investment

- During the tenure of the investment

- On maturity of the instrument

The table below shows the tax treatment at each stage for various investment options

We can see from the table above that, PPF and VPF are the most tax friendly investment options. Bank and Post Office Fixed deposits interests are taxable. Even NSC interest is taxable. However, the accrued interest in NSC is deemed to be reinvested for tax savings under Section 80C of the Income Tax Act, provided it is within the overall limit of Rs 1 lakh allowed under Section 80C, along with other tax saving investments. Therefore the investor can declare the accrued interest as "income from other sources" in the Income Tax Return, and at the same time claim an 80C deduction for the accrued interest. In effect, accrued interest income and reinvestment cancel out each other, making the investment tax exempt throughout the term of investment, except the year of maturity. In the year of maturity, the investor cannot claim an 80C deduction for the accrued interest, because the interest is re-invested but paid to the investor.

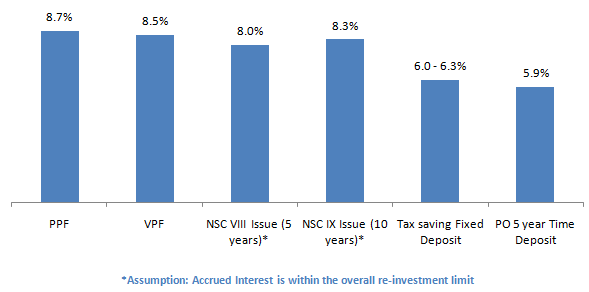

The chart below shows the annualized post tax return from these various investment options.

We can see from the chart above that PPF is the best post tax investment option for the investor. The returns from Bank and Post Office fixed deposits are lower due to the taxability of interest in these investment options. As long as the accrued interest is within the overall 80C limits, the returns from NSC are above 8%. However, if an investor makes a large NSC deposit every year, then along with other eligible 80C deductions like employee provident fund contribution, life insurance premiums etc there may not be enough room within the available 80C limit for the accrued interest to qualify for 80C deduction. It will then substantially reduce the post tax returns from NSC.

Liquidity

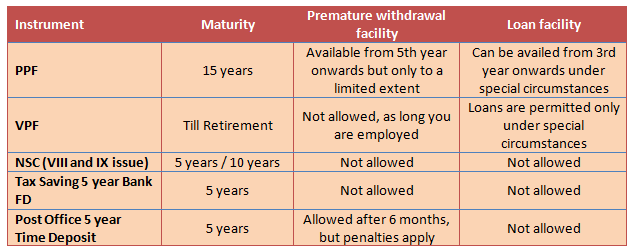

The other important investment consideration is liquidity. There is no general financial planning guidance on liquidity. It depends on the financial situation of the investor like, income, fixed expenditure, savings pattern, existing assets, liquidity of those assets etc. When you make an investment, you should make sure that you are comfortable with the liquidity of the investment that you are making. The table below shows the liquidity related considerations for these best investment options.

The table above shows that the liquidity of PPF and VPF is lower compared to other investment options. However, you can take loans from your PPF account from 3 years onwards, under special circumstances. In the case a Post Office time deposit, you can withdraw after 6 months, but if you withdraw before the expiry of one year from the date of deposit, simple interest will be applicable. For the others, if deposit is withdrawn after one year from the date of deposit, interest will be calculated 1% less than the rate specified for the period.

Conclusion

In this article we have seen that if the investor has a long time horizon and does not need liquidity from the investment before maturity, then PPF is the best investment option. VPF is also a good investment option for a long time horizon, but companies may have timelines beyond which VPF contribution will not be accepted. If you are interested in making a VPF contribution, then you should check with the payroll department of your employer, if you can still make VPF contributions. If you have a shorter time horizon for your investment, then you may find NSC to be a more suitable investment option. However, the post tax returns on NSC will depend on your other 80C deductions, as discussed above. You can consult with an expert financial planner and / or chartered accountant to discuss with best tax saving investment option is suitable for you. Time is of essence in tax saving investments. You should finalize your tax saving plan as soon as possible.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment