We have discussed a number of times on our blogs that term insurance is the best form of life insurance. It is a straightforward protection policy and the premium is much less than life insurance cum savings products. With a term life insurance plan you can get the optimal life cover and generate sufficient investible surplus to meet your long term financial goals. We have discussed why term plans are superior to traditional life insurance cum savings plans in our article, Taking term plan can be a smart Insurance choice. Once you have decided on buying a term life insurance, you should know that half the battle to provide financial security to your family in the event of an untimely death is won. In this blog we will discuss how to select the best term plan. You should go about the process of buying term insurance in a very methodical way and if you engage an experienced certified financial planner your job will be that much easier. There are 5 broad steps involved in buying the right term life insurance policy.

Determine the right amount of Sum Assured

You need to consider several factors in deciding how much life insurance cover is adequate for you. The insurance cover, also known as sum assured, should be adequate to cover the following:-

- How much debt do you have: If you are the only earning member of your family, your dependents may not be able to meet the debt obligation in the event of an untimely death. Home loan, car loan, credit cards and personal loans must be paid off in full. For example, if the outstanding principal balance on your home loan is

र25 lacs and your car loan isर5 lacs, you need a minimum insurance cover ofर30 lacs plus a little extra for accrued interest (not paid). If your spouse is also working, you should determine how much loan can he or she service, the balance must be paid off in full. - Income needs of your family: This is the biggest determinant of how much life cover you need. In the event of death, the income earned from the investment of the policy pay-out (also known as sum assured) should replace your current income. For example if your current monthly expense is

र50,000 and assuming you can get an annual pre-tax return of 7 - 8% on your investment, you will need an insurance cover ofर80 – 90 lacs. You should always add an additional amount, as a guard against inflation. As a thumb rule you may add your annual salary as the additional inflation guard to your sum assured. Your total sum assured, including inflation guard, in the example above should beर90 lacs - 1 crore. So if you have loans ofर30 lacs and an expense ofर50,000/month, you total insurance cover or sum assured should beर1.3 crores. - Future obligations: You also need to factor in your future obligations, like children's education, marriage etc. For example, if you need

र10 lacs for your child's higher education on an inflation adjusted, you should include that when you are calculating how much cover you require. If your child is 10 years old and if you can get about 12% returns from suitable child investment plans, you will need to make an investment ofर4 lacs. So, carrying on the above example, you should addर4 lacs to your required sum assured.

You can see the above method of calculating insurance cover factors, in how much funds you will require immediately, how much funds you will require on an ongoing basis and how much will you require at a future point of time, in the event of an untimely death. Determining the right sum assured is a critical aspect of life insurance. Being under-insured is as worse or, at best, only marginally better than being uninsured.

Determine the term of your life insurance policy

The term of your life insurance policy is as important as the sum assured. For example, if you are 25 – 30 years old and have a 15 year term plan, you will be left without life insurance by the age of 40 – 45. At that age health risks are much higher, particularly with respect to coronary and cardio-vascular diseases, than when you are younger. Buying new life insurance when you are above 40 is much more expensive than when you are younger. For example, the premium of a 15 year term plan for a 45 year old is more than double of 35 year term plan for a 25 year old (based on LIC Amulya Jeevan premium rates). If you take a longer term plan when you are young, you may be paying slightly higher premiums in the initial policy years, but your overall savings in your life insurance premiums over your entire working career will be much higher. You should try to get the right life cover for the longest term possible. Of course, there is the question of affordability. While you should not compromise on the amount of life cover or sum assured to get a longer term plan, term plans are advantageous in the sense that you can get a longer life insurance term at a much lower cost, compared to other types of life insurance plans. 60 is normally considered to be the retirement age, but nowadays, more and more people are working even beyond the age of 60. It is always a good practice to assess your life insurance needs from time to time, and if you feel that you will be working beyond the age of 60, it will be prudent to buy term plan to cover you even beyond the age of 60.

Compare Plans before you buy

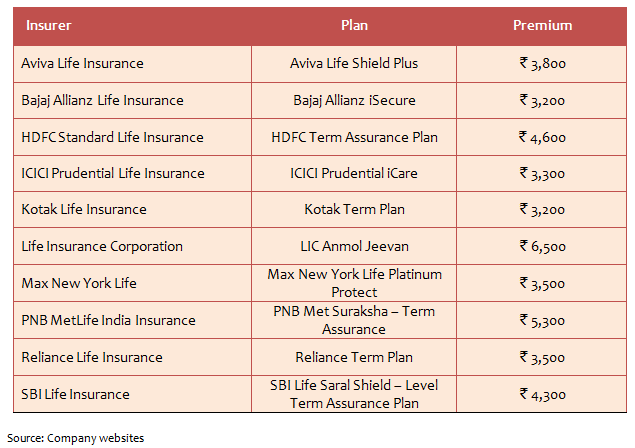

It is always advisable that insurance buyers compare different term plans before buying their life insurance policy, so that they can choose the right insurance policy for their needs. While cost is an important factor when buying an insurance policy, the claims settlement track record of the life insurance company is also an equally important factor. For example, while the premium of insurance plans of Life Insurance Corporation (LIC) is usually higher than other companies, the claim settlement ratio of LIC is also higher than other life insurance companies. There are a large number of term plans available in the market. You should note that, under the current insurance (IRDA) regulations an insurance agent are not allowed to sell products of multiple insurance companies. While the regulations may change in future, as of now, an insurance agent is not allowed to sell policies of more than one life insurance companies. Therefore, an insurance agent will obviously be biased towards the products of the company where he or she has the agency. A fee based independent financial planner or insurance advisor can help an insurance buyer buy the right policy. You can also buy term plans online after comparing different term plans, if you can devote the time and know what you need. We have compared premiums of some of the best term plans available in the market in our article The best term plans in 2016. The table shows the approximate term insurance premiums for a sum assured of ? 20 lacs and a policy term of 20 years. Please note that the premium rates are indicative only.

Choose a company with good claims settlement track record

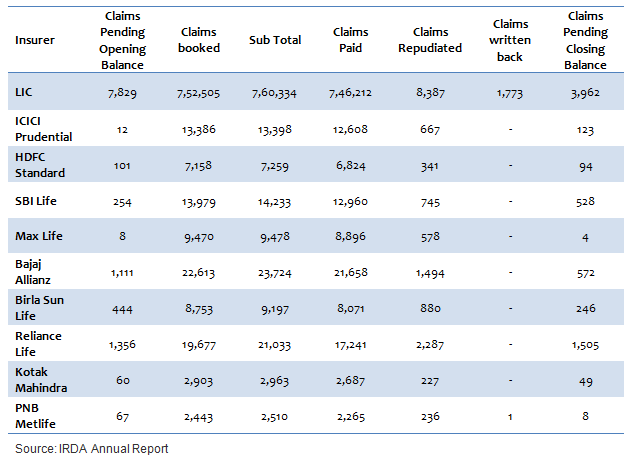

A cheaper policy is no good, if the life insurance company for some reason or another cannot fulfil the claim of the insured in the event of an untimely death. It defeats the very purpose to buying life insurance. Even if the life insurer fulfils the claim, if it takes a very long time to fulfil the claim it is certainly not a desirable situation for family of the insured to be in. We have discussed the claim settlement statistics of some of the largest life insurers in the country in our article, Best Life Insurance Companies in Claim Settlement. The table below shows the number of the death claims received by these life insurers, number of death claims paid by the insurers, the number of the death claims repudiated (rejected) and the number of the death claims pending to be processed at the end of the year.

Monitor your life insurance needs on an ongoing basis

Some insurance buyers think that once they buy adequate cover in a good life insurance plan from a reputed company, they assume that their life insurance needs are taken care of forever. This is a mistake. Financial situations of insurance buyers change with time. Compare your current income with your income ten years back. Hasn't your income grown several times? Your lifestyle would also have improved significantly. If you bought a life insurance plan ten years ago based on your income back then, the sum assured will not be enough to meet your family's current lifestyle and needs, in the unfortunate event of your untimely death. Therefore you should buy an additional term plan to cover that risk. Life Insurance needs have to be re-evaluated at a regular frequency and any additional sum assured if required, should be bought.

Conclusion

In this blog we have discussed 5 broad steps involved in selecting the best term life insurance policy that is most suitable for your needs. Life insurance is one of the most critical aspects of our financial planning. It is as important as investment planning in ensuring the financial well being of our families. I have seen many investors devoting much more mind space to investments compared to life insurance, while at the same time, spending much more on life insurance than investments. If you follow the steps outlined in this blog and choose the right term plan for your life insurance, not only will you be able to provide adequate financial security to your family, you will also be able to free up substantial financial resources to invest towards your other long term financial goals.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment