What is Mutual Fund Retirement Plans

Retirement or Pension plans offered by Mutual Funds do not get as much of mention compared to the other retirement planning solutions, e.g. PPF, life insurance pension plans etc. These schemes are essentially hybrid mutual fund schemes, i.e. they have both fixed income and equity allocations in their portfolios. Investors can invest either in lump sum amounts or through systematic investment plans. Investments in Mutual Fund pension plans, in most cases, qualify for Section 80C benefits under Income Tax Act. Post retirement the investors can withdraw their corpus on a lump sum basis or through systematic withdrawal plan at a chosen frequency (e.g. monthly, quarterly etc.) for their regular income needs during retirement. The balance units post withdrawals in either case remain invested and continue to grow in value.

Benefits of Mutual Fund Retirement Plans

- With higher allocation to equities, some mutual funds retirement plans can generate superior returns in the long run compared to other products like PPF, life insurance plans etc. However, various plans under the National Pension Scheme can also generate returns comparable to, if not better than, mutual fund retirement plans.

- Some Mutual fund retirement solutions offers higher flexibility in terms of asset allocation options

- Charges of mutual fund pension plans are much lower compared to insurance products. However, they are higher compared to NPS

Disadvantages of Mutual Fund Retirement Plans

- The returns on investments are not tax free, unlike some other products like PPF

- There is not a wide array of choices available in the market

Mutual Fund Pension Plans in India

Looking at the assets under management of the different mutual fund retirement plans, it seems that they are not as popular compared to the other retirement planning solutions like PPF, life insurance plans etc. On the other hand, over the last 3 years or so, these funds have given 11 – 15% returns, which are much higher than what the more popular retirement planning solutions generated over the same time period.

UTI Retirement Benefit Plan was the first fund to be launched in this space in 1994, followed by Franklin India Pension Plan in 1997. After a gap of 15 years, Tata Mutual Fund came out with a retirement savings fund in November 2011. Earlier this year Reliance Mutual Fund launched the Reliance Retirement Fund.

The funds from UTI and Franklin Templeton have around 40% of their assets allocated to equity, while the balance is invested in fixed income securities. The equity portions of both these schemes investment portfolios are concentrated in large-cap stocks in the equity portion, whereas the fixed income has more of corporate bonds and long term government securities. The Tata scheme offers three options:

- Progressive plan in which the minimum equity investment is 85%

- Moderate plan in which the equity investment is around 75%

- Conservative plans offer equity exposure ranging from 0-65%

The scheme automatically switches from one plan to another depending on the investor's age. At age of 45, investments under the progressive plan automatically switch to the moderate option while at the age of 60 investments in the moderate plan are switched to the conservative plan.

The Reliance Retirement Fund offers two options

- Wealth Creation

- Income Generation

In the wealth creation plan 93% of the investment portfolio is invested in equities, whereas in the income generation plan 80% of the investment portfolio is invested in debt and the balance in equities. One can opt for wealth creation or income generation plan, based on their age, risk profile and investment horizon.

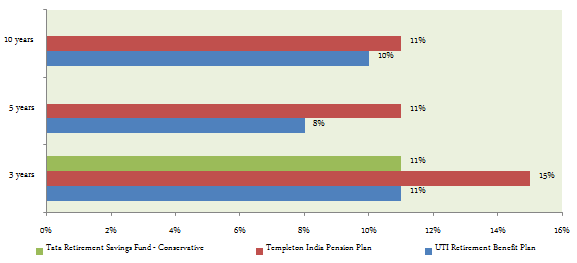

The chart below shows the 3, 5 and 10 year trailing annualized returns of the three comparable plans, UTI, Franklin Templeton and Tata (Conservative plan). NAVs as on November 9, 2015.

Annualized returns of UTI, Franklin Templeton and Tata (Conservative plan) are shown. The returns of Reliance Retirement Fund are not shown because it has not completed a year yet.

- UTI Retirement Benefit Pension Fund: UTI Retirement Benefit Pension Fund is one of the earliest schemes, launched in 1994 and has nearly

र1,580 crores assets under management. The expense ratio is only 2.23%. There is no entry load. An exit load of 5% is levied if the investor exits within one year, 3% if the exit is between one to three years and 1% thereafter, until retirement. Manish Joshi and V. Srivatsa are fund managers. The portfolio mix comprises 38% equity and 62% fixed income / money market investments. This is a 3 star rated fund as per Morningstar. - Franklin India Pension Plan: Launched in 1999 Franklin India Pension Plan has

र340 crores of assets under management. It has an expense ratio of 2.45%. There is no entry load. An exit load of 3% is levied if the investor exits before retirement. Anand Radhakrishnan, Anil Prabhudas, Sachin Desai and Umesh Sharma are the fund managers. The portfolio mix is 40% equity and 60% fixed income / money market investments. This is a 5 star rated fund as per Morningstar. - Tata Retirement Savings Plan: Tata Retirement Savings Plan has

र110 crores,र39 crores andर86 crores of assets under management for the progressive, moderate and conservative plan respectively. The expense ratio of the Tata Retirement Savings Plan is a little over 3%. While the portfolio mix is heavily weighted towards equity at 95% in the aggressive plan, equity allocation is 75% in the moderate plan and only 27% in the conservative plan. This is a 4 star rated fund as per Morningstar. - Reliance Retirement Fund: The Reliance Retirement Fund has

र230 crores andर63 crores of assets under management for the wealth creation and income generation plans respectively. The expense ratio of the Reliance Retirement Fund is a little over 3%. While the portfolio mix is heavily weighted towards equity at nearly 95% in the wealth creation plan, for the income generation plan the equity allocation is around 20%. Sanjay Parekh, Anju Chajjer and Jahnvee Shah are the fund managers.

Tax treatment of Mutual Fund Retirement Plans

Investment in Mutual Fund Retirement Plans is subject to tax deduction under Section 80C of Income Tax Act for most mutual funds retirement plans. However, the maturity proceeds of retirement plans are not entirely tax free. Non equity oriented mutual funds, i.e. the mutual funds where equity allocations are less than 65% are subject to debt fund taxation. Long term capital gains for non equity mutual funds are taxed at 20% after allowing for indexation benefits. Indexation benefits allow you to adjust the acquisition price of units by the ratio of cost of inflation index in the year of redemption and the year of purchase. As a consequence, while the long term capital gain for income tax purposes is not tax free, it is lower and hence the tax obligation is also lower compared to many other fixed income investments, e.g. fixed deposits etc. You should note that, for debt funds the minimum holding period for long term capital gains to apply for debt funds is 36 months.

Can we construct a mutual fund portfolio that gives better returns than retirement plans

Yes, it is possible. However, it calls for a certain level of investment expertise, which you can build, if you educate yourself about personal finance and investments. While, the retirement planning solutions currently available in the mutual funds space offers limited options, you can build your own portfolio comprising of diversified equity funds and income funds that meets your target asset allocation requirement. Such a portfolio will also be more tax efficient from the point of view of capital gains taxation at the time of your retirement. Let us understand this with the help of an example. Let us assume that you invest र 500,000 in a debt oriented hybrid retirement fund over a 20 year investment horizon. For the purpose of our example, the pre-tax compounded annual return of the retirement fund is 12%. Over 20 years, with a CAGR of 12%, your investment value will be a little over र 48 lacs. The long term capital gains will be र 43 lacs, which will be taxable as per the debt fund taxation norms explained in the previous section. Can you construct your own portfolio with diversified equity and income funds to generate the same returns as the retirement fund over a 20 year investment horizon? Yes, you can. If you invest र 1.5 lacs in a diversified equity fund giving 15% annualized returns and र 3.5 lacs in a long term income fund giving 10% annualized returns, you could have got the same returns as the retirement fund.

However, the post tax returns will be very different. In this case, the long term capital gains from the diversified equity fund will be र 23 lacs, which will be entirely tax free. Only the र 20 lacs capital gains from the debt fund will be taxable, as per the debt fund taxation norms. Therefore, if you construct your own retirement planning portfolio, with diversified equity and income funds, there is the potential to generate higher post tax returns. However, you should monitor the performance of your portfolio on a regular and make suitable adjustments based on your portfolio performance. Also, you should rebalance your portfolio from time to time to make sure that you have the most optimal asset allocation based on your retirement planning goal.

Summary

In summary, while on an absolute basis the returns of these pension plans is not as attractive as equity funds or even balanced funds, their performance is much better than a lot of other retirement solutions available in the market. Higher equity market returns over the long term make these products an effective inflation hedge for retirement. The UTI Retirement Benefit Pension Fund and Templeton India Pension Plan are suitable for investors with conservative risk profiles, while Tata and Reliance Mutual Fund offers variety of options for investors with different risk profiles. You can also create your own retirement planning portfolio by investing in diversified equity and income funds through Systematic Investment Plans. Consult Prajna capital with regards to the retirement planning solution that is best suited for your needs.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

-----------------------------------------------

No comments:

Post a Comment